On Friday, the jobs data hit—and it wasn’t good. Non-farm payrolls came in at just 22,000, far below the already low expectation of 75,000, and well short of the 53,000 that would have at least met consensus. By any measure, that’s a weak print.

It raises a big question: are we looking at the beginning of a major slowdown, or is something else going on beneath the surface?

In this post, I want to break down how to interpret this report, why it might not mean what the “perma-bears” think it does, and how it fits into the broader macroeconomic picture.

Framing the Question: Major Slowdown or Temporary Pause?

Whenever I see a headline-grabbing data point like this, I try to step back and ask a few simple questions:

- What are the main drivers of the economy right now?

- What should we expect to see if the bearish case is real?

- What doesn’t line up with that story?

With jobs data, the natural concern is that weak hiring means the cycle is rolling over. But to confirm that, we need to see reinforcing signals in credit, fiscal policy, inflation, and layoffs. Without those, a bad number might just be noise—or the result of something temporary.

The Post-Supply Shock Zone

Here’s my take: we’re still in the post-supply shock corridor.

The tariffs and policy volatility of the last few years created a pause in business activity, particularly in hiring decisions. That uncertainty is still working its way through the system. But like what we saw in the immediate post-Covid period, once the uncertainty clears, the macro economy tends to snap back.

Instead of a lasting slowdown, what we’re likely experiencing is the tail end of that pause—a “choke point” in demand—before moving into the late-cycle surge that tends to come when credit expands and businesses regain confidence.

Fiscal, Credit, and Inflation: What the Data Shows

Let’s look at the key indicators:

-

Fiscal policy: Yes, the pace of fiscal acceleration has slowed, but we’re nowhere near a collapse. Government spending is still supportive.

-

Credit growth: The private sector has drawn heavily on credit lines, similar to what happened in early 2020. This is new money creation, fueling demand and economic activity. That doesn’t look like recessionary behavior—it looks like positioning for the next leg of the cycle.

-

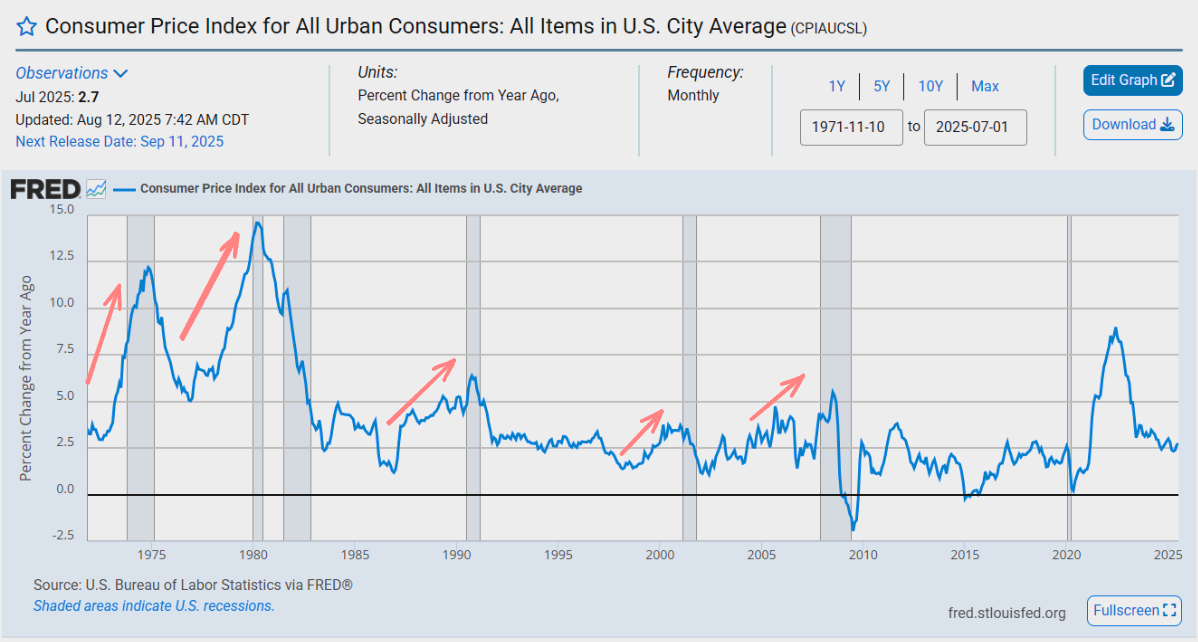

Inflation trends: In every past cycle, an end-of-cycle slowdown is preceded by a rise in inflation as wages and costs squeeze profit margins. But right now, inflation has been falling, not rising. That’s a sign of productive output, not of contraction.

Where Are the Layoffs?

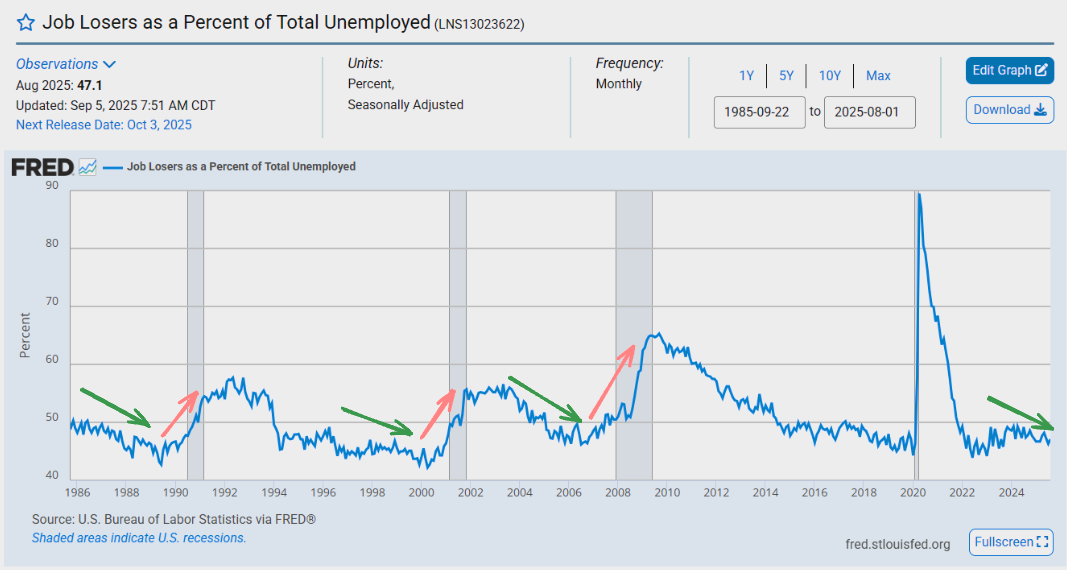

Another important piece: if we were truly at the edge of recession, we’d see layoffs accelerating sharply. Historically, recessions always begin with a sudden surge in job losses.

That’s not happening. Instead, what we see is a flattening of payrolls—companies hitting pause, not cutting staff. That’s consistent with uncertainty around tariffs and policy, not a collapse in demand.

What Happens Next

When uncertainty clears and credit growth kicks in, the economy tends to rebound quickly. That’s why I believe we’re much closer to the snapback phase of this cycle than to a true downturn.

Yes, inflation will eventually rise again, and at that point layoffs will start to pick up. That’s the real end-of-cycle dynamic. But we’re not there yet. In fact, we may even start to see CPI surprises to the upside as soon as this week, signaling that the speculative, late-cycle environment is returning.

The Bottom Line

The weak jobs number looks bad at first glance. But step back and consider the bigger picture:

- Fiscal support is still strong enough.

- Credit growth is accelerating.

- Inflation is falling, not surging.

- Layoffs aren’t spiking.

Put all that together, and the better explanation is that we’re still in the post-supply shock adjustment phase. Once certainty returns, the economy should push into the final, more speculative leg of the cycle before a true slowdown arrives.

For a more complete analysis, you can catch the full video here: