Over the past six months, the S&P 500 has staged an incredible rally—one that was very much in line with what my models had projected earlier this year. Back at the start of 2025, following the tariff tantrum and the heavy selloff, we flagged the market’s move as a clear mispricing. Flows were simply too strong to justify the decline, and sure enough, the rebound has been powerful.

But as we head into October, the winds that fueled this rally are beginning to shift. What were tailwinds over the summer are now turning into headwinds. The key message I want to make clear is this: I believe we’re at an inflection point, and volatility is likely to spike in the near term. The rally looks exhausted, and a breather—possibly a sharp one—is overdue.

The First Domino: Treasury Flows and the Tax Drain

The most important factor right now comes down to fiscal flows. The daily Treasury statement is, in many ways, the first mover of macroeconomic outcomes.

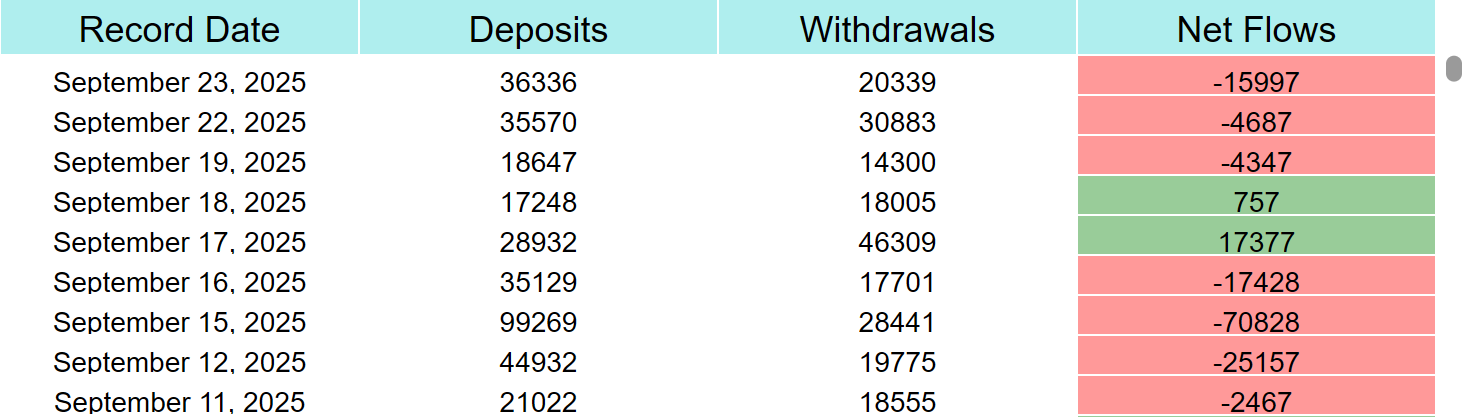

Each September, we see a major corporate tax drain. This year, starting around September 11th, roughly $120 billion was pulled out of the private sector over a two-week period. On its own, that may not change the long-term trajectory of the economy—but in the short run, it significantly pressures the balance sheet capacity of the financial sector.

Here’s why this matters:

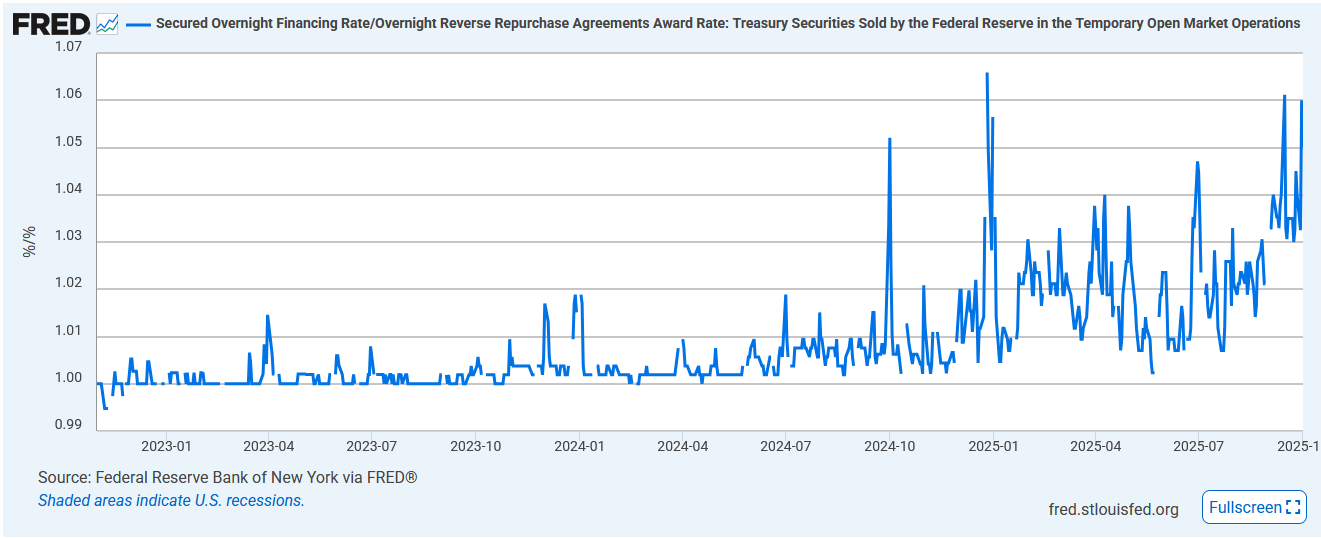

Reverse Repo is Drained: In the wake of stimulus and Treasury issuance, reverse repo balances had been providing a cushion. But today, they’re effectively drained.

Cash Is Tightening: With cash hunting for the best yield, spreads are opening up between SOFR and the RRP award rate. That spread is a signal—balance sheets are tightening, and liquidity is less available.

Knock-On Effects: As reserves get scarcer, financial institutions pull back. They become less willing to expand into risk assets, and in some cases, may even sell. This takes away the buying pressure that helped sustain the rally.

The result is a system on thin ice: not systemic like 2008, but enough to squeeze balance sheets and put short-term downward pressure on equities and other risk assets.

Layering on Risk: A Government Shutdown

As if tight fiscal flows weren’t enough, we’re staring down the likelihood of a government shutdown. Normally, these events have become “non-events” for markets—they come and go, spending resumes, and the lost paychecks are eventually reimbursed.

But this time feels different.

Timing: A shutdown right now collides with already tight reserve conditions, removing spending that could otherwise have helped offset the tax drain.

Policy Risks: Added to that, the threat—at least rhetorically—of federal layoffs injects another layer of uncertainty. Even if layoffs don’t materialize, the slowdown in spending is enough to exacerbate financial pressures.

Market Complacency: Because markets have largely shrugged off shutdowns in recent years, complacency is high. That makes the risk of surprise-driven volatility even greater.

In short, we’re hitting a potential fiscal snag at exactly the wrong time.

A Volatile October Ahead

Put these pieces together—an exhausted rally, tightening liquidity, a significant tax drain, and the looming government shutdown—and the case for a volatile October becomes strong.

To be clear, I’m not calling this the end of the cycle or “the top of tops.” But markets are stretched, overbought, and overdue for a correction. How deep that correction runs will depend on how these exogenous variables play out. In the best case, we get a breather. In the worst, a sharper selloff fueled by cascading balance sheet pressures and heightened uncertainty.

Either way, traders and investors should prepare for turbulence.

Final Thoughts

I’ll be covering these developments in more depth in upcoming live streams, including a breakdown of the mechanics and models I use to track flows and market pressure points. If you’re an Applied MMT Pro member, you can find my full analysis and in-depth research on appliedmmt.com

.

As always: good trading, follow the flows—and we’ll see how this October unfolds.

Watch the full video here →