As Bitcoin continues to carve out a larger and larger share of the global financial system, the question of what truly drives its price has never been more important. For years, commentators have pointed to “Fed liquidity” as the main force behind Bitcoin’s price action. But as I argue in my latest video, this explanation doesn’t hold up under scrutiny. Instead, the evidence strongly suggests that fiscal flows—not monetary liquidity—are the true driver of Bitcoin’s long-term price trajectory.

Why “Fed Liquidity” Falls Short

In the post-COVID era, analysts have been quick to tie Bitcoin’s movements to changes in so-called Fed liquidity. Whether through quantitative easing (QE), reverse repos, the Treasury General Account (TGA), or reserve balances, the idea was that when the Fed injected liquidity, Bitcoin’s price would rise.

But there’s a fundamental flaw in this argument: Fed liquidity only swaps assets, it doesn’t add new ones. QE and related tools merely change the composition of private sector balance sheets; they don’t create new net financial assets. That means there’s no direct channel for these measures to bid up Bitcoin—or any other financial asset—in a sustainable way.

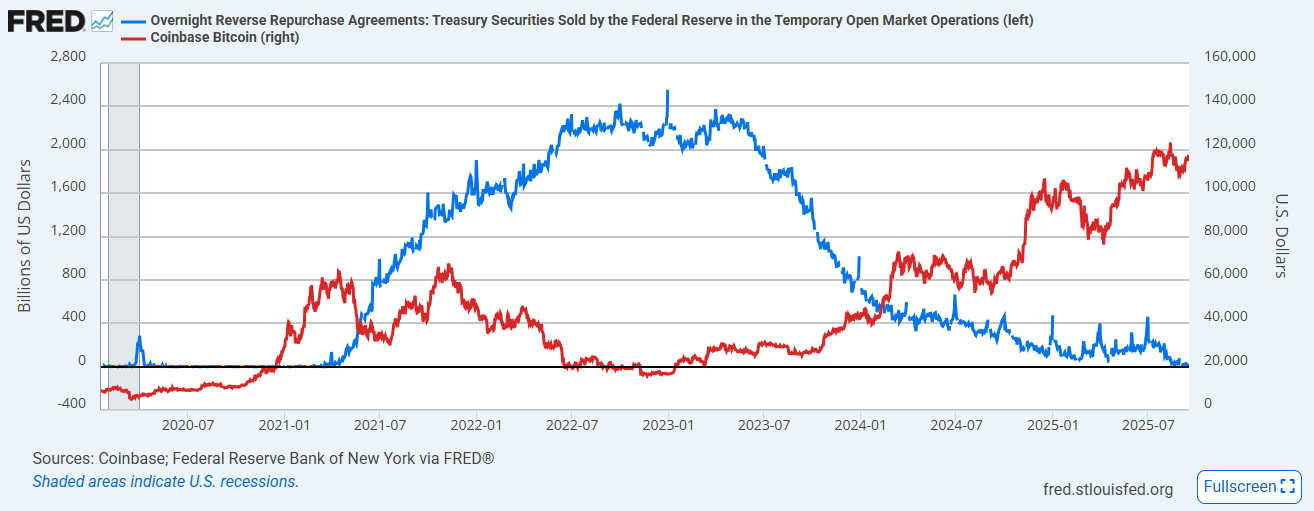

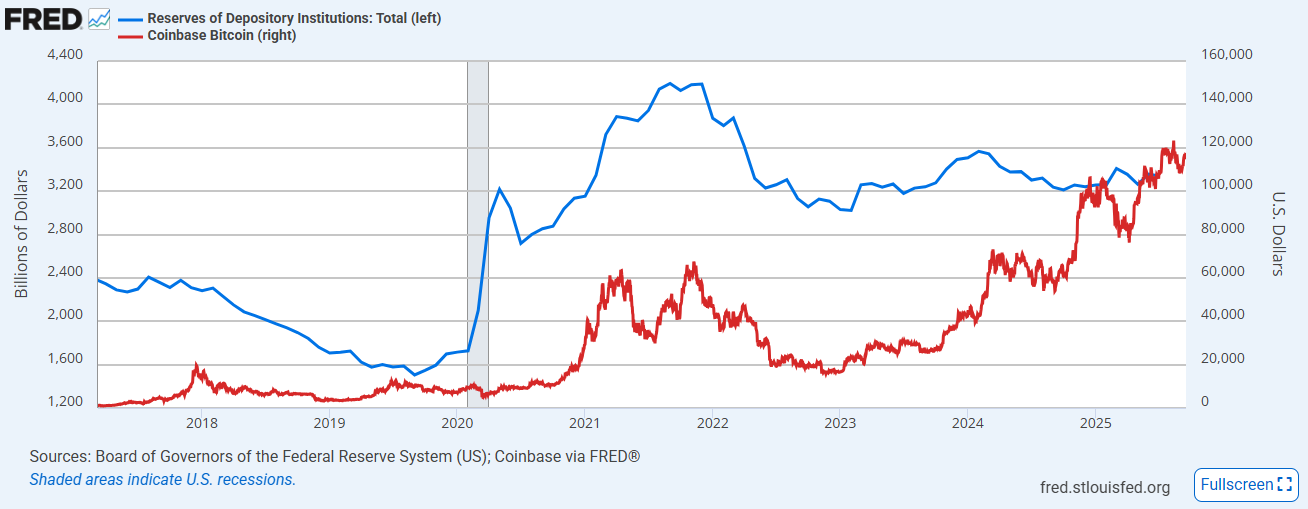

We saw this play out in real time. For example, when reverse repos surged between 2021 and 2022, Bitcoin collapsed alongside broader markets. Reserves spiked after COVID but later flattened out, while Bitcoin continued to trend upward. The supposed correlation unraveled, exposing the liquidity story as a head fake.

Fiscal Flows: The Real Driver

The real story lies in fiscal policy. From a Modern Monetary Theory (MMT) perspective, government spending is fundamentally different from Fed liquidity. When the government spends, it injects net new financial assets into the private sector. These flows become the income and profits of businesses and households, fueling credit creation, investment, and ultimately asset prices.

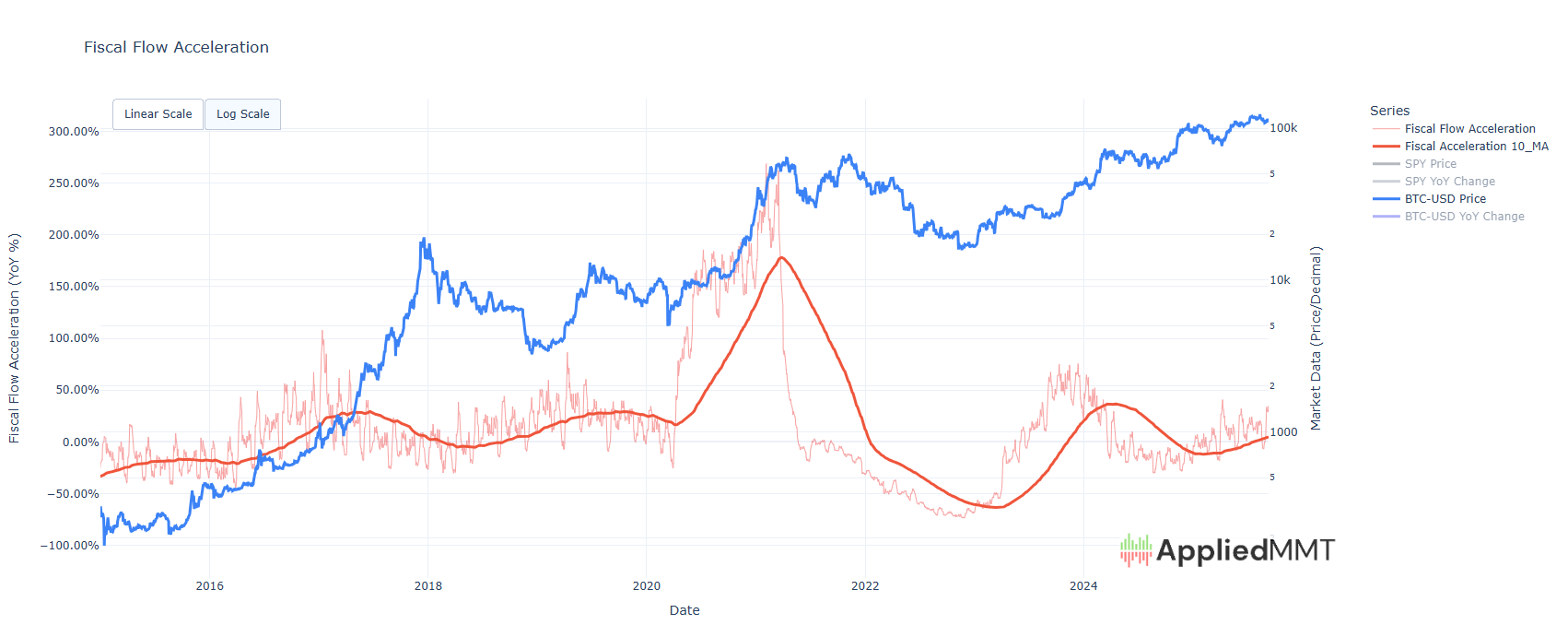

To capture this, I’ve developed a new tool at AppliedMMT: the Fiscal Flow Acceleration model. Built from Daily Treasury statement data, it measures the pace and acceleration of government spending. What we find is striking: Bitcoin’s price consistently lags fiscal flows by about 10 months. In other words, fiscal injections today show up in Bitcoin’s valuation nearly a year later.

We confirmed this relationship using statistical tools like Granger causality tests. The results show clear predictive power between fiscal flows and Bitcoin prices, especially in that 10–16 month window. Correlation doesn’t equal causation, but when you pair theoretical grounding with empirical testing, the causal link becomes hard to deny.

Implications for Bitcoin and Beyond

This insight has wide-reaching implications. If Bitcoin is systemically tied to fiscal flows, then it’s not just a speculative asset riding on monetary whim—it’s directly embedded in the fiscal-credit cycle that underpins the broader economy. That means policymakers and investors alike need to pay close attention to fiscal conditions, not just Fed policy, to understand Bitcoin’s trajectory.

And the connection isn’t limited to Bitcoin. The same dynamics play out across the S&P 500 and other major assets. Fiscal spending uplifts the entire financial sector by expanding private balance sheets. But Bitcoin, as a high-beta asset, appears especially sensitive to these flows.

What About Interest Rates?

Of course, interest rates still matter—but in a secondary way. Portfolio rebalancing across the financial sector means that when rates fall, Bitcoin may behave similarly to tech stocks, benefiting from a relative shift toward risk assets. Conversely, rising rates may weigh on Bitcoin as investors rotate into safer yields. But these effects pale in comparison to the sheer power of fiscal flows.

The Bottom Line

Bitcoin has been part of the investable asset universe for barely 15 years, and already its fate is deeply tied to fiscal policy. As balance sheet space continues to fill with Bitcoin exposure, a fiscal-driven shock could ripple through the entire financial system.

That’s why, as traders and investors, we must “follow the flows.” Fiscal policy is the fuel, and Bitcoin is one of the clearest gauges of its downstream impact. Ignore this link at your own risk.