Over the past five months, the S&P 500 has gone essentially nowhere.

Yes, we’ve made marginal new highs. Yes, we’ve had bursts of volatility. But zoom out and what you see is a market stuck in sideways consolidation dating back to early October. The S&P is up barely 1–1.5% over that stretch. The Nasdaq is actually down slightly.

So the real question is:

Are we building pressure for a sustained breakout — or setting up for another leg lower first?

To answer that, we have to step away from the noise and focus on what actually drives price.

And if you’ve followed my work for any amount of time, you know exactly where this is going:

Flows.

Markets Follow Flows — Not Narratives

Heading into Q4 of last year, I laid out the case that we were likely to see volatility increase. Why?

Because underlying fiscal flows were slowing down.

That deterioration in flows — partly tied to tariff dynamics earlier in 2025 — suggested we were entering a weaker liquidity backdrop. We did get volatility, but instead of a dramatic selloff, we’ve largely just gone sideways.

That part has played out exactly as expected:

- Slower flows

- Weak upside momentum

- Repeated rejection of new highs

Now we’re at an inflection point.

To determine what comes next, I don’t just look at flows in isolation.

I look at flows relative to sentiment.

And that’s where things get interesting.

Why Sentiment Matters

Price alone doesn’t tell you enough.

You can compare flows to price and get a sense of fair value — but sentiment adds something critical:

It tells you what the market is pricing into the future.

The biggest moves don’t happen when flows and sentiment are aligned.

They happen when they diverge.

When:

- Flows are improving but sentiment is overly bearish

- Or flows are deteriorating while sentiment is excessively bullish

That misalignment creates opportunity.

We saw this clearly during the tariff-related selloff earlier in 2025. Into the April lows, sentiment was crushed. But flows were surging post-tax season. The selloff was too deep relative to the fiscal backdrop.

That was a high-conviction buy.

And the snapback rally followed.

The Flow–Sentiment Model

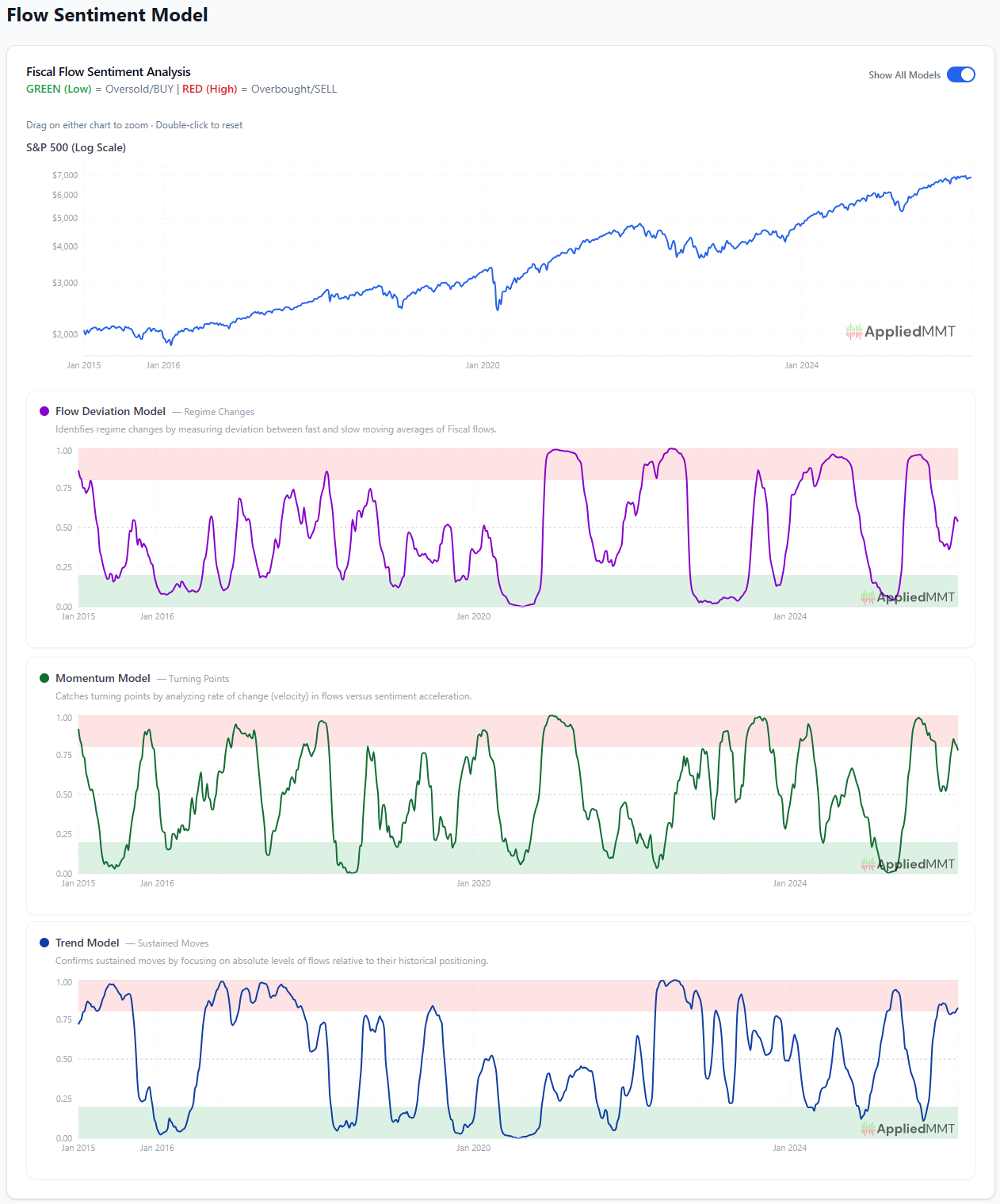

To systematize this process, I built an ensemble sentiment model that evaluates flows from three different perspectives:

1. The Flow Trend Model (Moving Average)

This is the first-order view.

It compares sentiment relative to the moving average of underlying fiscal flows. It’s steady, grounded, and gives a clean baseline of where price should be relative to liquidity conditions.

2. The Momentum Model (Acceleration of Flows)

This is faster.

Instead of just asking where flows are, it asks:

Are flows accelerating or decelerating?

This model tends to move earlier — sometimes generating more signals — but it’s excellent at detecting building divergences before they fully materialize.

3. The Regime Trend Model (Absolute Flow Levels)

This is the slowest.

It looks at the absolute level of spending over time and helps identify broader regime shifts. It’s less tactical but useful for bigger-picture positioning.

Each model has strengths and weaknesses. Together, they create a layered view of how aligned (or misaligned) markets are relative to liquidity.

Where We Stand Right Now

We recently received updated sentiment data, and here’s how things stack up:

- Sentiment: Neutral

- Flow Trend: Neutral

- Momentum: Recently shifted from sell back to neutral

- Regime Trend: Slightly leaning sell (due to last year’s slowdown)

So what does that tell me?

It tells me we’re not quite there yet.

Flows remain relatively weak compared to last year. Sentiment is not washed out. The market hasn’t truly reset.

And that leaves open the possibility of one more leg lower.

What I’m Watching For

Here’s the setup I’d prefer to see:

- A final push lower in price

- Sentiment getting meaningfully more bearish

- Bearish positioning rising

- Seasonal re-acceleration of fiscal flows heading into April

Seasonally, flows tend to strengthen into that window.

If we get that combination — crushed sentiment alongside strengthening flows — the models would likely stack up into a high-conviction buy signal.

That’s the type of setup where I’d feel far more comfortable getting aggressive and putting risk back on.

That’s the type of environment where a break above the 7,000 level on the S&P 500 could actually stick.

Without that reset?

We remain cautious.

The Big Picture

Here’s what matters most:

Markets are balance sheet machines.

Fiscal flows expand private sector balance sheets. That expansion has to go somewhere — and it typically goes into asset prices.

When flows are strong and sentiment is skeptical, that’s fuel.

When flows are weak and sentiment is complacent, that’s risk.

Right now, we’re somewhere in between.

Which is why patience matters.

Final Thoughts

Could we break out from here?

Yes.

But the higher-probability setup — in my view — involves one more shakeout first.

If that happens and flows re-accelerate as expected, the opportunity could be significant.

Until then, stay measured.

Stay data-driven.

And as always:

Follow the flows.

If you’d like access to the flow–sentiment models discussed here — along with all of my data tools, weekly updates, and macro dashboards — you can explore them at:

And if you prefer to watch the full breakdown, you can view the video here: