The Trump 2.0 era has officially begun, and it’s off to a fast-paced start. In just a few days, we’ve seen sweeping changes, executive orders, and policy shifts that are already making waves. While political discussions abound, my focus here is on what really matters to traders and investors: the markets. Specifically, how will this new administration’s fiscal priorities impact market movements in the months and years ahead?

Setting the Stage: A Bull Market in Transition

As we stand today, markets are on the edge of all-time highs. This follows nearly two years of a relentless bull market that has pushed asset prices steadily higher. The key question is whether this momentum will continue in the Trump 2.0 environment, or whether we’re about to see a shift.

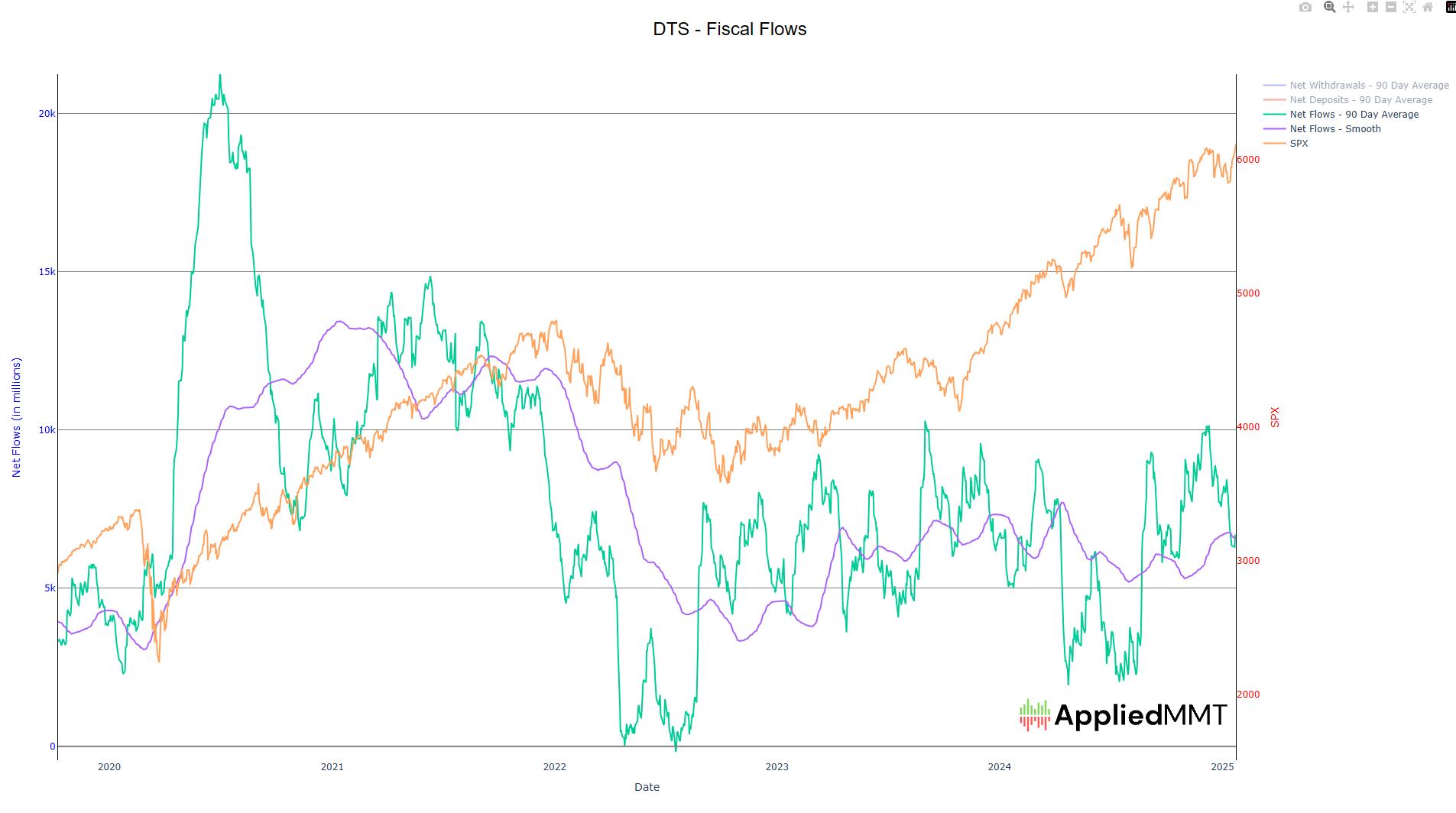

To answer that, we need to focus on the primary driver of markets over the past several years: fiscal flows. The fundamental idea here, rooted in Modern Monetary Theory (MMT), is that government spending adds financial assets to the private sector. Those assets, whether saved or spent, ultimately funnel into financial markets, driving asset prices higher.

In short, fiscal flows are the lifeblood of the markets. When government spending accelerates, markets tend to follow suit. Conversely, when spending slows, so do markets.

The Data Speaks: Fiscal Flows and Market Correlations

One glance at the data shows a strong correlation between net fiscal flows (the purple line) and S&P 500 performance. When government spending increases, markets tend to rise. When spending slows, markets often pull back. This dynamic has been remarkably consistent, making fiscal flows a critical metric for anyone looking to anticipate market trends.

As we transition into the Trump 2.0 era, the question is: Where are these flows headed?

Key Risks and Opportunities in Trump 2.0

Let’s break this down into risks and opportunities based on the policy changes we’ve seen so far.

Risks to Fiscal Flows

-

Department of Government Efficiency (DOGE):

One of the new administration’s first executive orders was to establish the Department of Government Efficiency (DOGE), with a stated goal of cutting up to $2 trillion in spending. While this sounds dramatic, the practical reality is that most U.S. government spending is non-discretionary (e.g., Social Security, healthcare), making cuts of that magnitude highly unlikely. At most, we might see $250-$500 billion in spending reductions, which could modestly impact flows. -

Energy Tax Credit Cuts:

Trump’s executive orders include eliminating certain energy tax credits, potentially increasing government revenues by $100-$200 billion. While this isn’t a direct spending cut, it does represent a slowdown in fiscal stimulus. -

Pausing Biden-Era Spending Initiatives:

Key spending programs, including portions of the CHIPS Act and infrastructure investments, have been paused. While details remain unclear, this could slow approximately $300 billion in planned spending.

Opportunities for Fiscal Flows

One major positive for fiscal flows is the non-discretionary nature of much of government spending. Programs such as Social Security, Medicare, and other healthcare expenditures are deeply entrenched and unlikely to be reduced significantly. These programs represent a consistent and substantial injection of financial assets into the private sector, helping to support markets even when discretionary spending slows.

Another overlooked driver of fiscal flows is interest income generated from higher interest rates. Even as rate cuts become a possibility, current rates are still providing substantial support to household and corporate balance sheets. This will likely remain a tailwind for markets in the near term.

What Lies Ahead

Looking forward, the trajectory of fiscal flows will depend heavily on the Trump administration’s ability to balance spending cuts with new investments. While there are risks, including spending slowdowns and paused initiatives, the stability provided by non-discretionary spending offers a critical foundation for fiscal flows.

For now, fiscal flows remain moderately strong, supporting the ongoing bull market. However, the key inflection point to watch will be tax season in April 2025, when we’ll get a clearer picture of government revenues and spending priorities.

Final Thoughts

As investors, our job isn’t to predict every policy move but to monitor fiscal flows and adapt accordingly. These flows are the first cause of the economic cycle, and their impact on markets cannot be overstated.

For now, stay tuned, keep an eye on the flows, and as always—good trading!

Watch the full video here: