A theme we've been hearing about for over a year in various forums is how foreign Central Banks (particularly those in BRICS countries) have been aggressively accumulating physical gold. Business Insider described the phenomenon in an article published last October:

Global central banks have been snapping up record amounts of gold since the start of 2022 - a trend that should continue as countries look to move away from an 'overconcentration' of reserves in the dollar, according to State Street Global Advisors.

Monetary authorities across nations made net purchases of 387 metric tons of the yellow metal in the first half of 2023, after buying an unprecedented 1,083 tons the whole of last year, the world's fourth-largest asset manager said in a recent note.

In addition to reserve diversification, the trend is also driven by central banks' desire to strengthen balance sheets and increase liquidity without adding credit risk, according to the firm.

'The reasons driving central bank gold purchases — to diversify their reserves, improve their balance sheets, and gain liquidity from an asset without credit risk — likely won't change given today's increasing economic and geopolitical risks,' Maxwell Gold, head of gold strategy at State Street, wrote in the note. 'Therefore, as we look ahead, we expect central banks to continue their role as net purchasers of gold,' he added. The trend appears to be part of a broader international movement - known as de-dollarization - to reduce reliance on the dollar in trade and investment, after the US leveraged the greenback's supremacy to impose economic sanctions on some countries. China and Russia have led the anti-dollar drive, which also saw the BRICS group of nations weigh the prospect of a shared currency.

'In recent years, the Society for Worldwide Interbank Financial Telecommunications (SWIFT) payments system has been used to impose sanctions, both on Iran in 2015 and on Russia in 2022 — a tactic some have described as "weaponization,"' Gold wrote.

'If a government perceives international sanctions as a real threat, then switching from US dollar assets to an anonymous counter like gold becomes extremely attractive, particularly in scenarios of multi-lateral sanctions by several reserve currency nations,' he added.

A colleague and I were discussing the recent surge in the price of gold, and he referenced a research piece that made similar arguments. Luke Gromen, a Chartered Financial Analyst and founder of FFTT [Forest For The Trees] LLC with a nearly 250k Twitter/X following, wrote the following [emphasis original]:

The long-held FFTT view on US trade and economic policy (that Wall Street consensus often ridiculed) is becoming US economic orthodoxy, with all that entails for trade, FX, and markets.

Yellen is in charge of the USD & appears to have decided that US economic and trade policy of the last 40 years, which amounts to 'The US imports goods and exports debt' is no longer good for America, and will therefore change.

Yellen is in essence adopting the long-held FFTT view that shifting to settling US deficits in a neutral reserve asset that floats in USD terms (gold now, maybe BTC at some point) will stimulate US reshoring and a US and global economic renaissance. This is massively bullish for gold, BTC, US industrial equities, nominal GDP growth, and US inflation. Let’s watch.

First, neither Janet Yellen nor anyone at the US Treasury for that matter is “in charge of the USD.” The US Treasury is a department within the Executive branch of the US government; the Constitution appoints Congress, i.e. the Legislative Branch, with that responsibility. Congress has since outsourced those responsibilities largely to the Fed.

Second, the phrase “settling US deficits” is nonsensical. Anyone who has any experience settling trade accounts and processing payments would scratch their head at this comment. US firms purchase and sell goods and services internationally. When purchases exceed sales over a given period (i.e. imports exceed exports), it is said the US is running a trade deficit. That deficit is a measure of actual exchanges that have taken place. In other words, the trades have already settled. The very existence of the deficit is proof they're already settled. If the trades didn't happen, there would be no deficit!

Consider Walmart. Walmart generates roughly half a trillion in sales annually. Analysts estimate that around three quarters of Walmart's merchandise is sourced from Chinese manufacturers. Needless to say, Walmart is a very large customer to these Chinese firms. It's reasonable to assume that if Walmart suddenly picked up and left overnight, these firms would be stuck with inventory they can't sell, crushing their cash flow and likely forcing them to close shop.

Walmart conducts its business in USD. Why? Because Walmart is a US firm that has to pay taxes in USD to the US federal government. As per the MMT money story, taxes drive demand for the government's currency. Walmart needs to accumulate tax credits so that it can satisfy its tax debts. Further, legal tender laws in the US require parties to accept USD as settlement for contract disputes. For these reasons and others, is simply cheaper and more efficient for US firms to conduct their business using US Dollars.

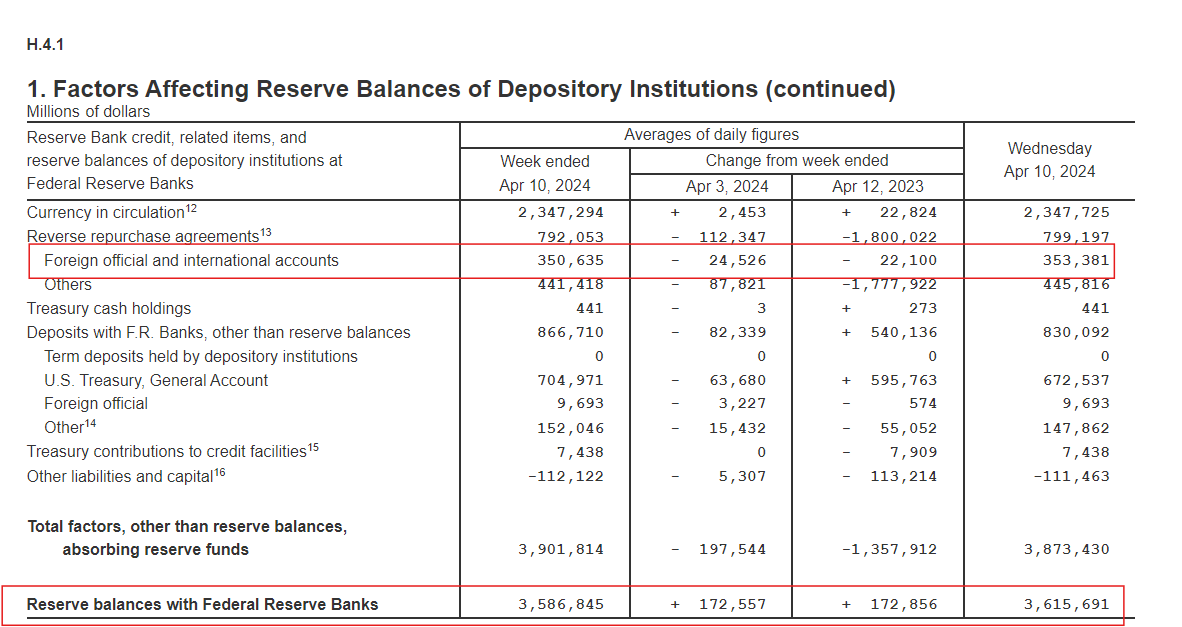

When Walmart pays for wholesale merchandise from a Chinese manufacturer, its Treasury department sends instructions to its bank to make the necessary payments on its behalf. These payments ultimately clear at the Fed: Walmart's bank and the PBOC both have accounts at the Fed. See below, from the Fed's latest report H.4.1:

When Walmart makes a payment, its bank recognizes the cash outlay by marking down not only Walmart's deposit balance (which is the bank's liability) but also its own "Cash and due from banks" balance (which is the bank's asset). "Cash and due from banks" is reflected on the Fed's balance sheet as "Reserve balances with Federal Reserve Banks," as shown above. To clear the payment, the Fed debits "Reserve balances with Federal Reserve Banks" and credits the PBOC's reserves in "Foreign official and international accounts." Presumably, the Chinese manufacturer uses a bank which has an account at the PBOC, and the appropriate accounts are debited and credited to reflect the higher USD balance.

Notice how at no point does Janet Yellen need to decide what currency to use to "settle" the trade; the trade is settled by the Fed in its normal course of operations, i.e. debiting and crediting the relevant accounts. The instructions came from Walmart. Additionally, there is no change in the aggregate size of the Fed's balance sheet to accommodate the settlement of this trade. Reserve balances at Federal Reserve banks and Foreign official and international accounts went down and up by equal amounts. From that perspective, the "supply" of outstanding USD balances is unchanged. The only change is the composition of the Fed's balance sheet. And if the decline in reserve balances with FR banks puts upward pressure on the federal funds rate, the Fed can supply additional reserves through open market operations.

This remains true even if somebody along the chain decides they want to hold Chinese Yuan (CNY) instead of USD. The PBOC can create as much CNY as it wants, so if the manufacturer wants to be paid in CNY, it can do so by selling USD and buying CNY in the FX market. By definition, in such a transaction their counterparty is buying USD and selling CNY. Once again, the USD balance has not "gone away," it has simply been transferred to a different account.

So what does all this have to do with gold? For whatever reason, central banks around the world (including the Fed) hold gold on their balance sheet. Why they do so is anyone's guess - most likely it is a legacy position from a bygone era that central bankers believe gives their currency "credibility." In practice, this creates an artificial scarcity of the yellow metal, restricting the supply in circulation and thus supporting its price. It's functionally a public subsidy for the gold industry.

When the PBOC "diversifies" its USD reserves by purchasing physical gold bars, it is effectively transferring its USD balance to someone else's account at the Fed. As with every other example provided earlier, there is no aggregate change in the balance of outstanding USD; it was simply transferred. As China's central bank raises its bid for the price of gold, sellers that hit its bid realize a capital gain. If the sellers are US-based, the physical bars are shipped to China and the Fed debits the PBOC's USD reserves and credits the gold seller's bank's reserves. The net effect is an economic transfer from the PBOC to the gold seller.

People often refer to gold as a "safe haven" to park one's savings. The reality is that protecting one's principal balance in gold requires finding a "greater fool" to buy it at a higher price, including central bankers. It is best thought of as a speculative commodity in this regard, because compared with other metals such as copper, nickel, iron ore, or lithium, gold has very little industrial utility. It does have commercial use, for example in jewelry, and is also sometimes still used by governments to mint special commemorative coins. In the past, gold was valuable because governments (including the US federal government) guaranteed a certain price for it. Today, gold's "value" is mostly a function of its relative scarcity, which can be attributed to central banks. The US federal government owns the world's largest gold supply at 8,100 tons. Imagine what would happen if it started liquidating its holdings! Storage costs alone would cause people to substantially down-bid any offerings. So, by hoarding gold reserves, governments continue to support the price of gold, which is ironic, considering goldbugs tend to be anti-government types.

Gold is heavy and expensive to ship and store. The idea that it will replace the US Dollar as a settlement unit for payments is completely absurd - Walmart is not going to be sending gold bars to China to pay for stuff anytime soon. Total GDP for the world is around $100 trillion; the United States makes up around a quarter of that. It's inconceivable that the global economy could sustain that amount of activity if final trade settlements required shipping gold. And claiming gold or Bitcoin are "neutral" assets in any way shape or form makes no sense given those have some of the highest ownership concentration rates of any asset in the world.

We won't begrudge others for speculating on the price of gold or trying to front-run large central bank purchases. That being said, it's important for people to understand the risks they are taking when doing so.