A recurring theme in the MMT literature is how language influences our understanding of money and monetary operations. Consider the following passage from L. Randall Wray's book Modern Money Theory:

Note that we still say that we have filed our "tax return" when we pay taxes. What did we "return?" We returned to our sovereign government its own currency (along with a statement showing how much we owed). In the old days, we would "return" to government its coins, tally sticks, paper money, and other forms of currency in order to meet our tax obligation. This is called "revenue" when received by government. The English word derives from the French "revenu," which in turn comes from the Latin "reditus," which means "return" or "coming back." What is "coming back" to the government when taxes are paid? The government's own currency.

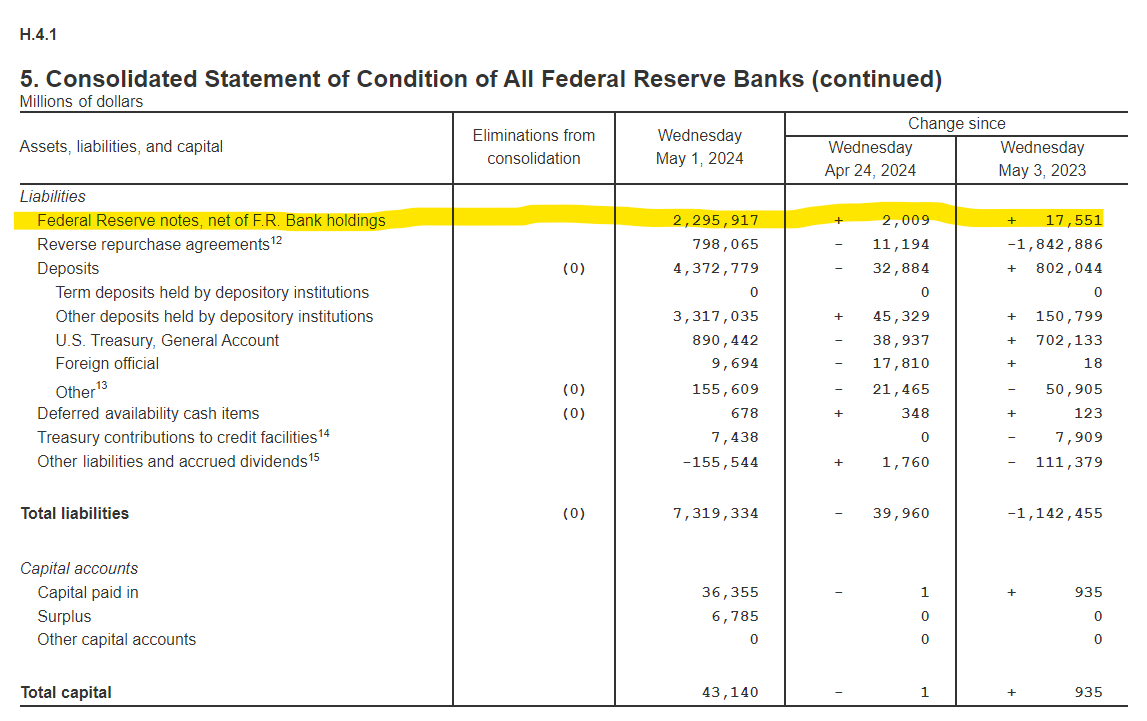

Or, consider that the top of a dollar bill of any denomination reads "Federal Reserve Note." "Note" here is short for "Promissory Note," a legal term of art that is frequently used in debt contracts. Similar language is used on US Treasury securities (e.g. Treasury Notes) and corporate debt securities (e.g. Apple Inc. 4.45% Notes due 2044). Standard mortgage contracts make use of the terms "Note" and/or "Promissory Note." Following that logic, a Federal Reserve Note (i.e. dollar bill) can be thought of as a debt/liability/obligation/IOU of the Federal Reserve. Indeed, Federal Reserve Notes are explicitly listed as liabilities on the Fed's balance sheet:

That's right: the physical cash sitting in your pocket or locked in your safe is ostensibly your asset and the Fed's liability.

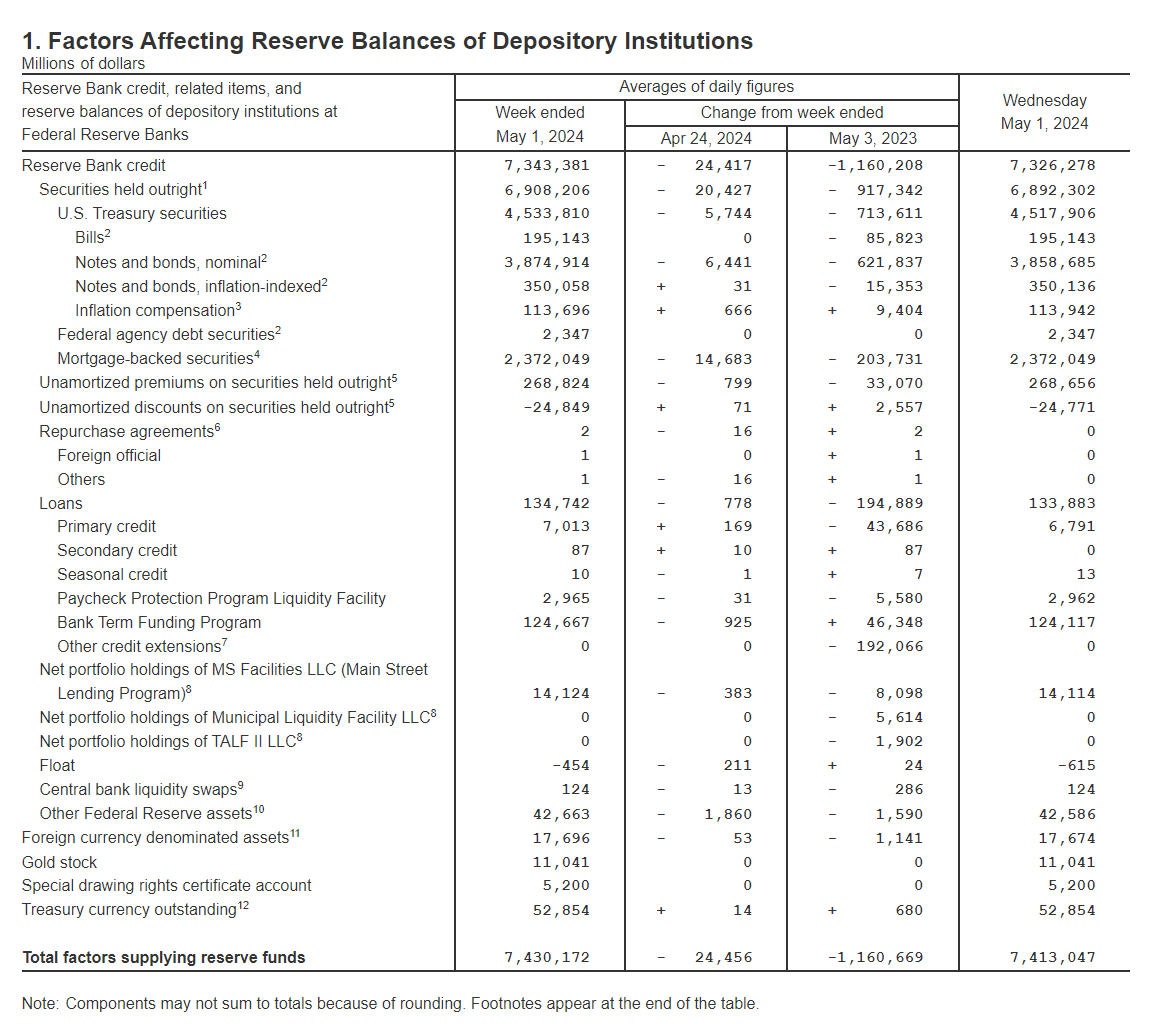

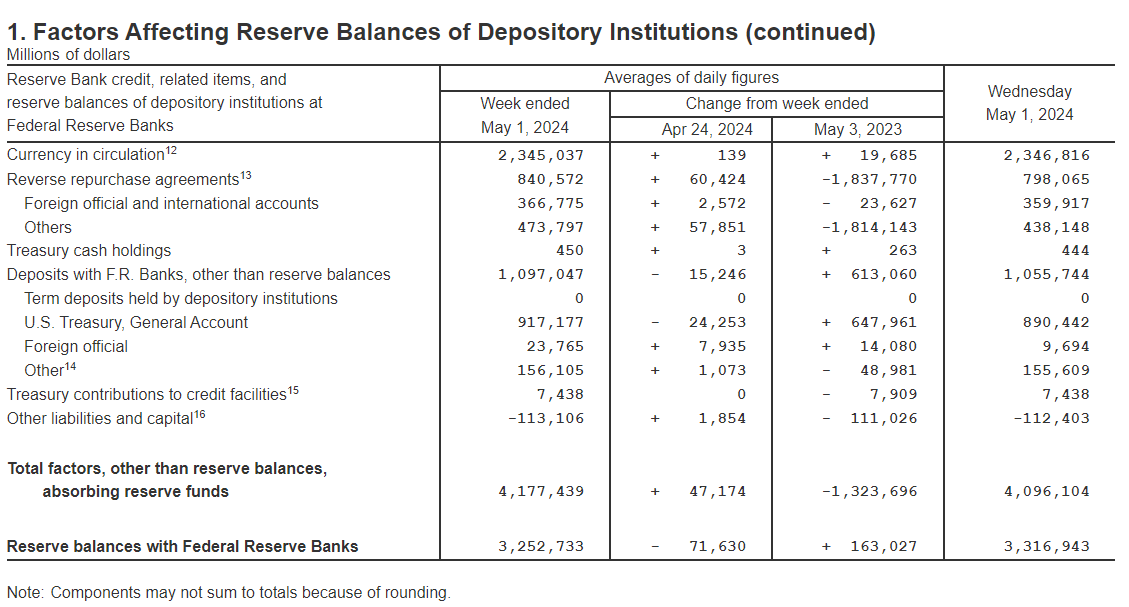

From the same report H.4.1, published weekly by the Fed, we can find on Table 1 the "Factors Affecting Reserve Balances of Depository Institutions and Condition Statement of Federal Reserve Banks." This table includes certain of the Fed's balance sheet items and sorts them into three categories: Total factors supplying reserve funds, Total factors, other than reserve balances, absorbing reserve funds, and Reserve balances with Federal Reserve Banks. The latest iteration is included below:

Once again, notice the language used here. "Total factors supplying reserve funds" are principally assets on the Fed's balance sheet, consisting primarily of US Treasury securities and Agency securities. Their total is equal to the sum of the other two factor categories, which are Fed liabilities. When the Fed buys securities, it supplies reserve funds to depository institutions who hold accounts at the Fed. It's right there, in plain English. Other factors, such as Reverse repurchase agreements and the US Treasury General Account, absorb reserve funds. Think about that for a moment: the Fed acknowledges in its own reports that the cash in the US Treasury's General Account "absorbs" reserve funds. Those reserve funds cannot be "absorbed" unless they are first supplied by the Fed (a dry sponge won't absorb any water if dropped into an empty bucket; one needs to fill the bucket with water first!). Quite literally, the Fed has to prefund/advance the funds first before they can be absorbed into the TGA. The Fed in effect "pays for" the Treasury's spending ahead of time. This is standard operating procedure.

Once again, by focusing on the specific language the Fed uses here, we can see MMT assertions such as "tax revenues and bond sale proceeds don't fund the US government, it's actually the other way around" are evidently true and correct.