Warren Mosler recently gave a masterclass on Bloomberg's Odd Lots podcast, explaining his position and rationale for his heterodox view that the Fed's rate hikes are contributing to the higher-than-normal inflation we've been experiencing.

Unsurprisingly, folks with differing views took to Twitter/X to critique Mosler's argument. One back-and-forth in particular included one of our prior podcast guests, Derek McDaniel (@rateofinflation), who made reference to that podcast episode:

Mosler’s arithmetic is very wrong.

— Cullen Roche (@cullenroche) July 9, 2024

Raising rates caused $5T of bond losses and he’s worried about a few extra $100B going to the Fed, foreign govts and rich people who don’t even spend it back into the economy? That’s without even calculating the lost credit expansion.

It’ll take at least 5 years of hikes to make up just the bond losses. You could MAYBE argue rate hikes are stimulative in the long term, but they’re absolutely not in the short term.

— Cullen Roche (@cullenroche) July 9, 2024

And that’s without even getting into the specifics behind who’s getting all the interest (Fed,…

Mr. Roche continues to explain his position in the following:

IMO the main thing people miss about the interest payments is the distribution of payments. It's easy to read that we're paying $1.1T in interest per year and assume that's inflationary.

— Cullen Roche (@cullenroche) July 9, 2024

That's a $500B increase since the Fed started raising. And of that $500B 65% of it is going… https://t.co/VDSUOWrZCn

IMO the main thing people miss about the interest payments is the distribution of payments. It's easy to read that we're paying $1.1T in interest per year and assume that's inflationary.

That's a $500B increase since the Fed started raising. And of that $500B 65% of it is going to the Fed, intragovt and foreign accounts. The rest is going mostly to domestic retirement accounts and rich people who don't spend it. So there's far less than ~$200B of extra income in a $28T economy due to hikes. That's not moving the inflation needle much.

And none of this even considers lost demand from unaffordable credit (raising rates primarily hurts low income borrowers who can't borrow now) or the $5T in bond losses incurred from the rate hikes.

First, this argument completely ignores the impact of interest paid on reserve balances (IORB), which is the primary channel through which the rate hikes flow through the financial system! This is an absolutely essential point we've been making for almost two years now, which is that the conditions under which the Fed began its recent rate hike cycle were genuinely novel in our nation's history. Never before had we experienced such an extreme increase in the Fed Funds Rate (FFR) as we had in 2022.

Not only that, but only since 2008 has the Fed even paid IORB; and for the majority of time between 2008 and 2022, FFR was at or near 0%. While it's true the Fed bought substantial amounts of U.S. Treasury securities during post-GFC Quantitative Easing programs, the reality is those Treasuries were replaced with reserve balances, which earn interest paid out directly by the Fed! It's nonsensical to argue the interest income on Treasuries doesn't flow through to the private (non-government) sector while completely ignoring this very basic fact.

There are several additional ramifications to consider. The mechanism by which rate hikes are administered are basically immediate. Before the Fed paid IORB (and interest on RRP balances), monetary policy operations were conducted exclusively with Fed and Treasury coordination. The Fed would buy or sell Treasuries via Open Market Operations (or Repo) to add or remove reserves at sufficient quantities consistent with hitting their target rate range. Buying Treasuries adds reserves to the banking system and pushes FFR lower, and vice versa. It's why MMT argues Treasuries' primary function is to act as a "reserve drain." When Treasury issues securities, the Fed shifts the amount purchased out of reserve balances and into the Treasury's General Account.

While changes in the Fed's policy rate would affect pricing at the margin, the actual interest paid out would increase with a lag, thanks to the timing of new Treasury issuance. If the Fed raised rates, each incremental auction of Treasury securities would be priced at a higher rate, but that would only apply to a fraction of the amount of securities outstanding, because Treasury issues securities in maturities ranging from 4-week bills to 30-year bonds.

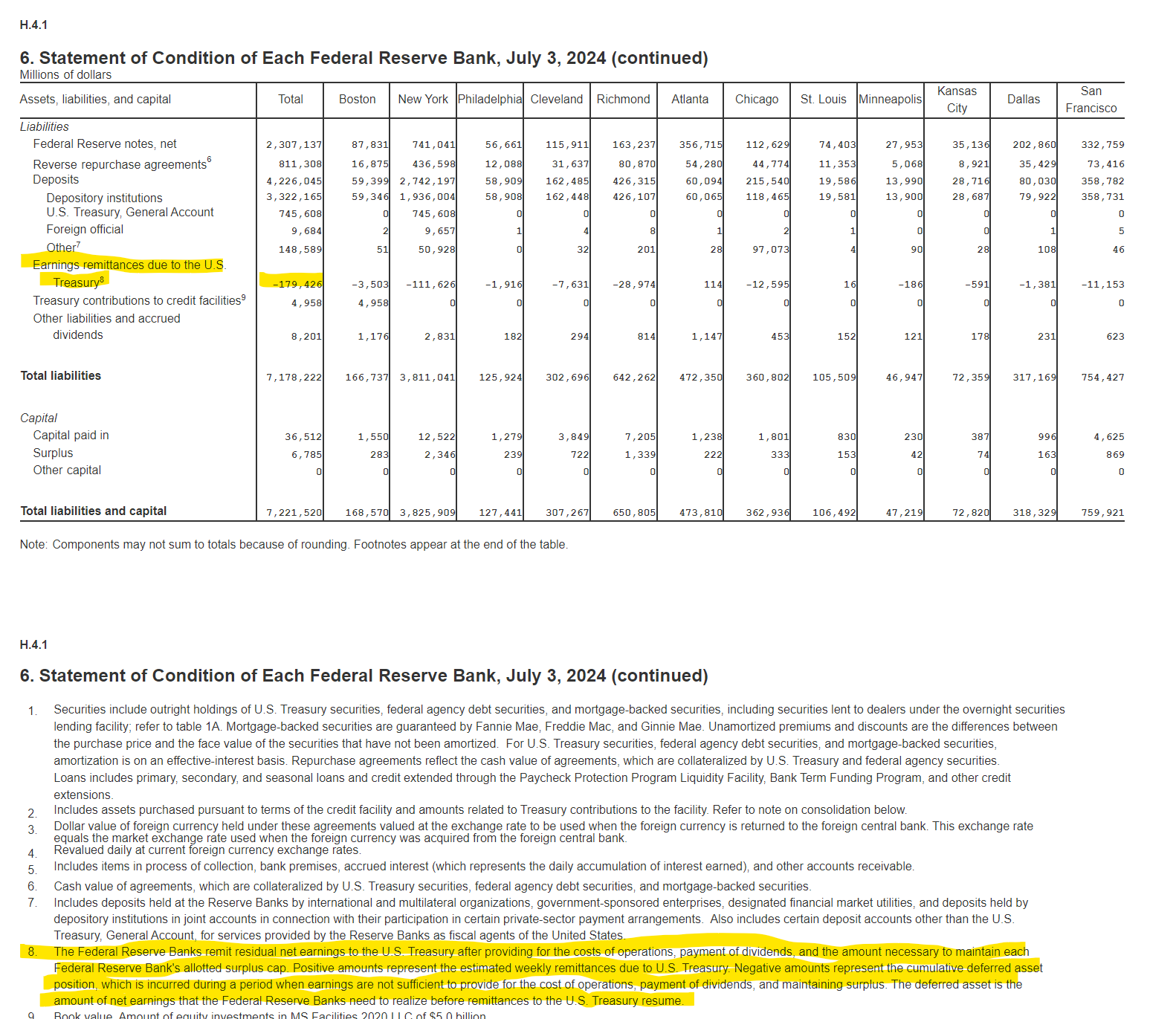

Now that the Fed pays IORB, the impact is more immediate, and the ample quantities of reserves due to years of QE amplified this effect. In fact, as per its latest report H.4.1, the Fed has accumulated a $179 billion loss thanks to the cost of its liabilities (including IORB) exceeding the interest earned on assets (including Treasury securities):

Note too that the $179 billion loss is a net number. Assuming the Fed's balance sheet size has averaged around $8 trillion and its assets have averaged a 4% yield over that period implies $320 billion of income from interest-earning assets. To generate a net loss of $179 billion implies gross payouts on liabilities of nearly $500 billion. And that is in addition to Mr. Roche's $200 billion estimate of Treasury interest paid to the private sector. The speed and scale through which the Fed's rate hikes have flowed through the financial system are truly unprecedented.

He further argues that the interest payments go to "domestic retirement accounts and rich people who don't spend it." This is the "Marginal Propensity to Consume" (MPC) argument we've heard ad nauseam. First, the assertion that retired folks don't spend their income is absurd (you can't take it with you, after all!). As we've argued, increasing payouts to retirees has caused a boom in demand for travel and leisure services, including cruises. Just this past weekend, the WSJ published an article titled "'We're Not Dead Yet.' Baby Boomers' Good Times Drive the Economy."

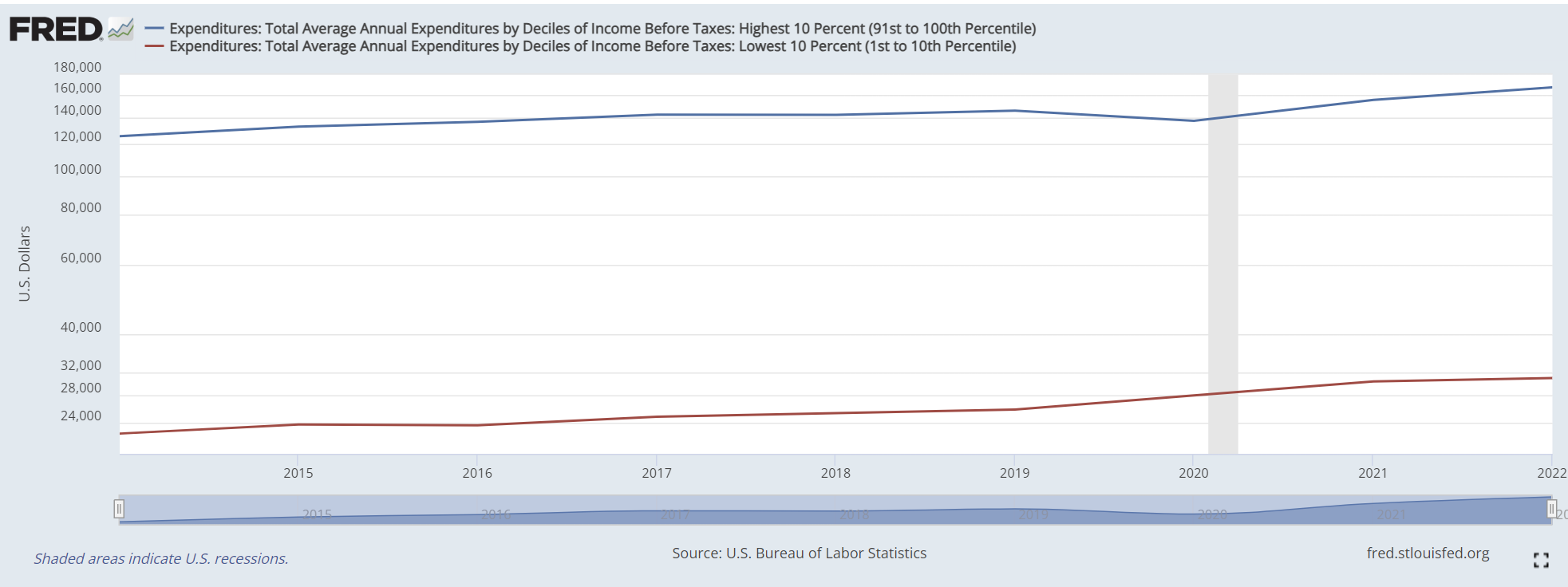

Second, spending by high-income earners far exceeds low-income counterparts. This should be intuitive. See a comparison in personal expenditures by the top 10% of U.S. earners vs. the bottom 10% below:

Focusing on MPC ignores the incredible scale of the interest income channel. And should it really be all that surprising that the largest spenders in the economy spend the free dollars that Uncle Sam hands out to them?

Prolific Twitter/X user, portfolio manager, thought leader, and MMT evangelist Mike Green recently estimated MPC of interest income at around 50%:

There were a few papers on this topic in the 1990s looking at propensity to spend tied to capital income/wealth. Propensity to spend out of interest was like 5x that of wealth gains (cap gains), but still relatively low. My numbers suggest ~50%.

— Michael Green (@profplum99) July 5, 2024

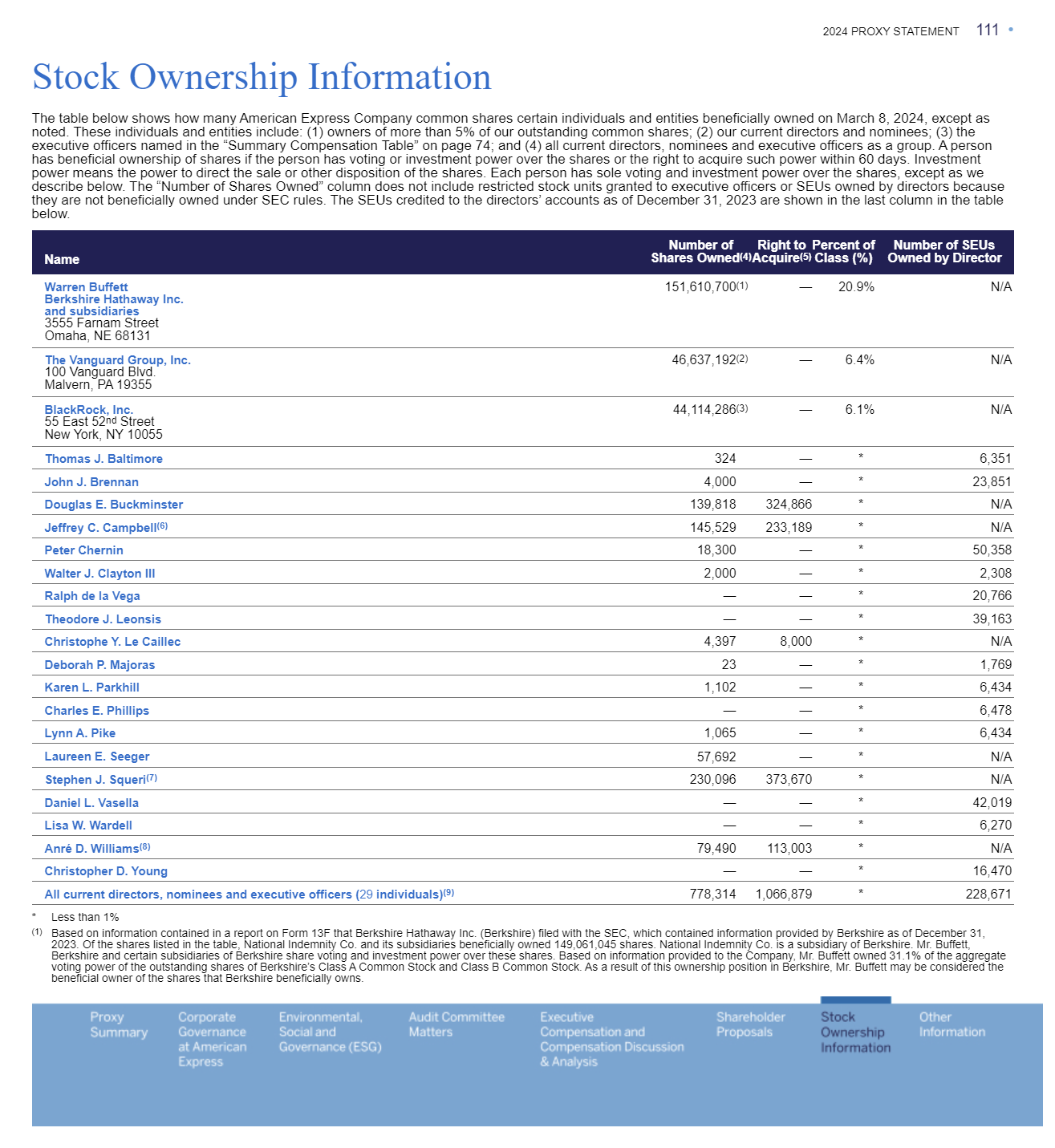

At the very least, what this does is create pricing power for companies who sell goods and services to the wealthy. While consumption of actual units may stay the same, higher prices of those units can be supported by higher incomes. It should come as no surprise that wealthy folks tend to be less sensitive to price increases, because they generally have ample capacity to pay higher prices. Consider how American Express ($AXP), who caters to wealthier consumers, trades at a 18x earnings multiple (and generates a higher ROE with better growth) whereas competitors in the consumer finance industry who service lower-income consumers trade in the high-single-digit/low-double-digit range:

It's no wonder why Warren Buffett loves this stock, as his Berkshire Hathaway is the largest shareholder of American Express with a 21% stake:

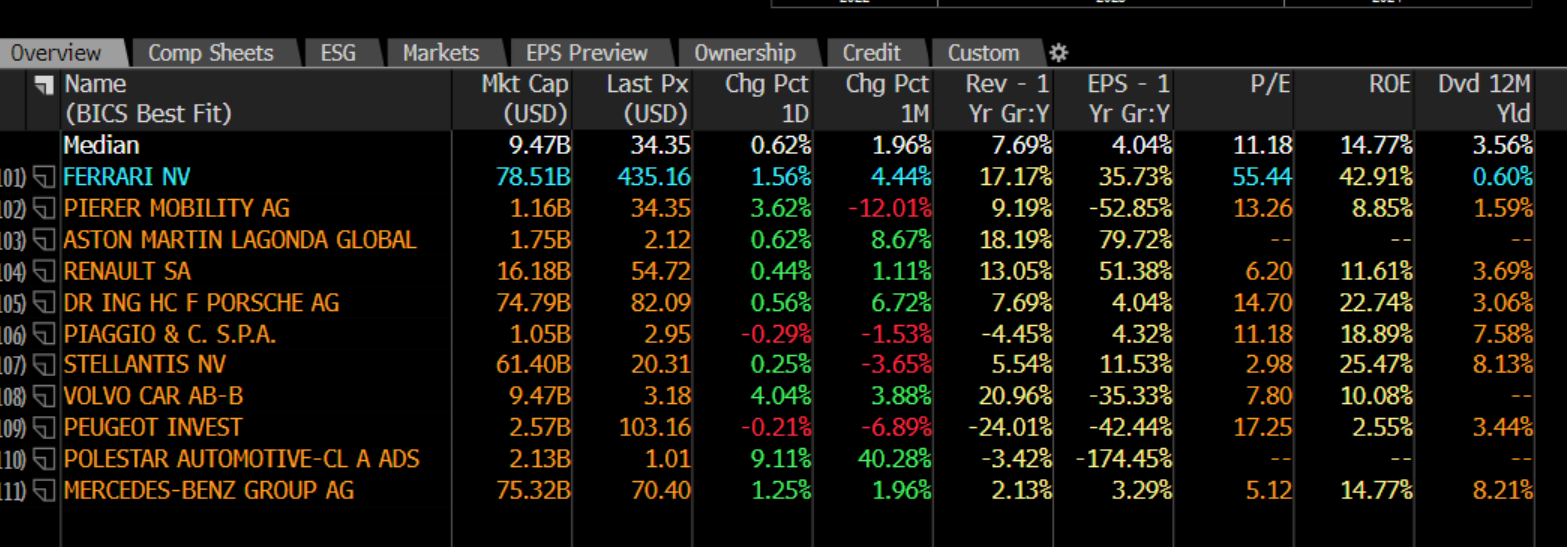

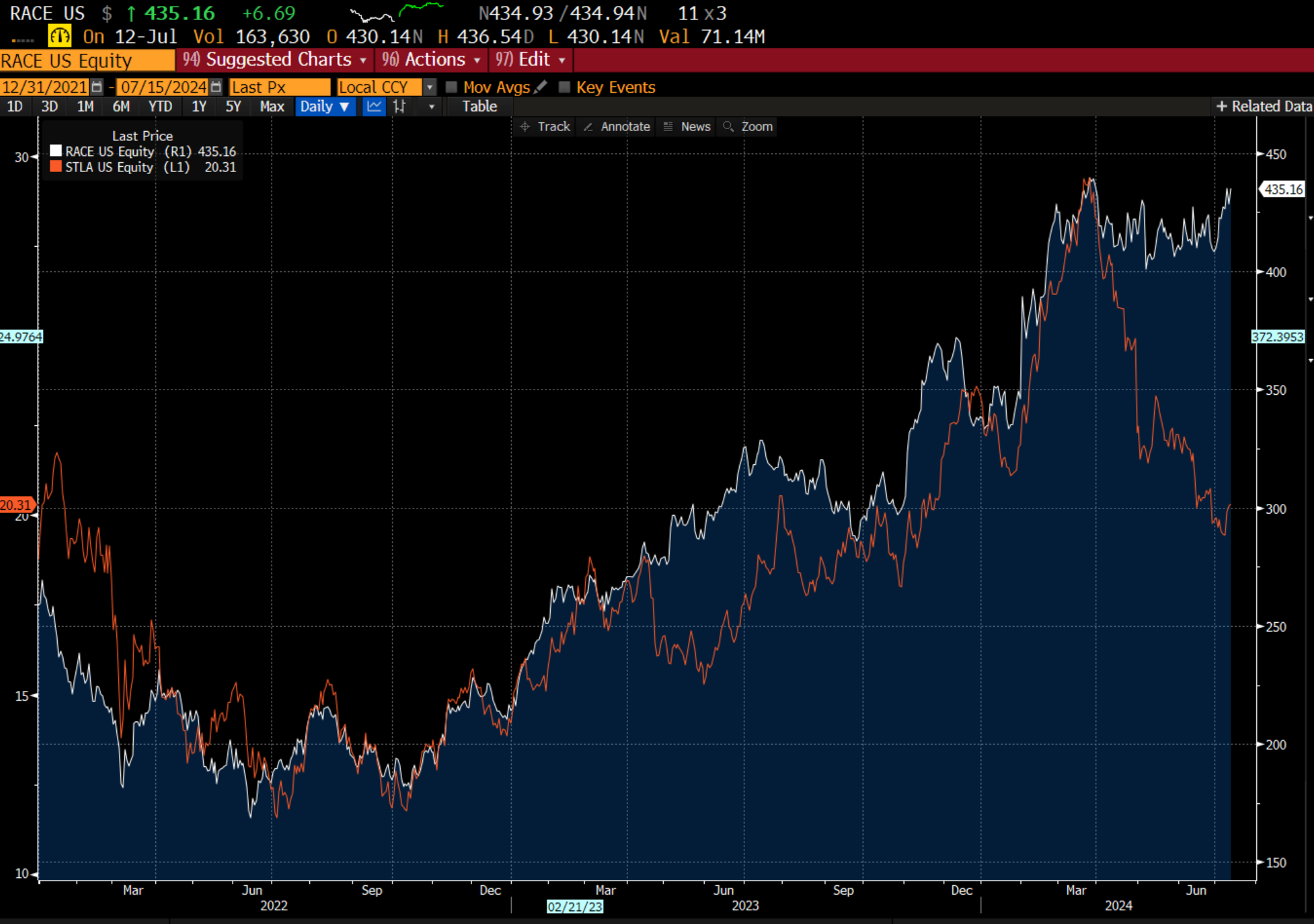

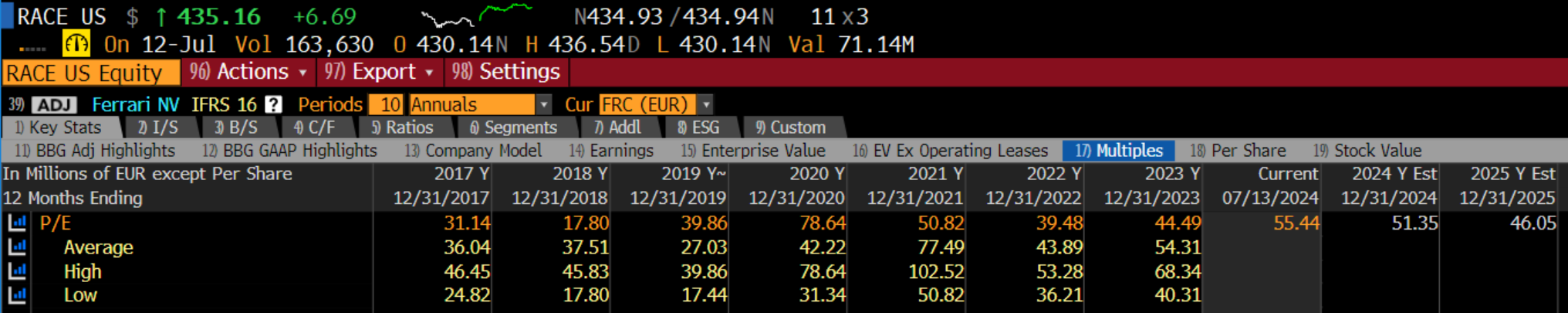

Or perhaps consider Ferrari NV ($RACE), which according to Bloomberg trades at a 55x P/E multiple and generates a 43% ROE versus industry averages of 11x and 15% respectively:

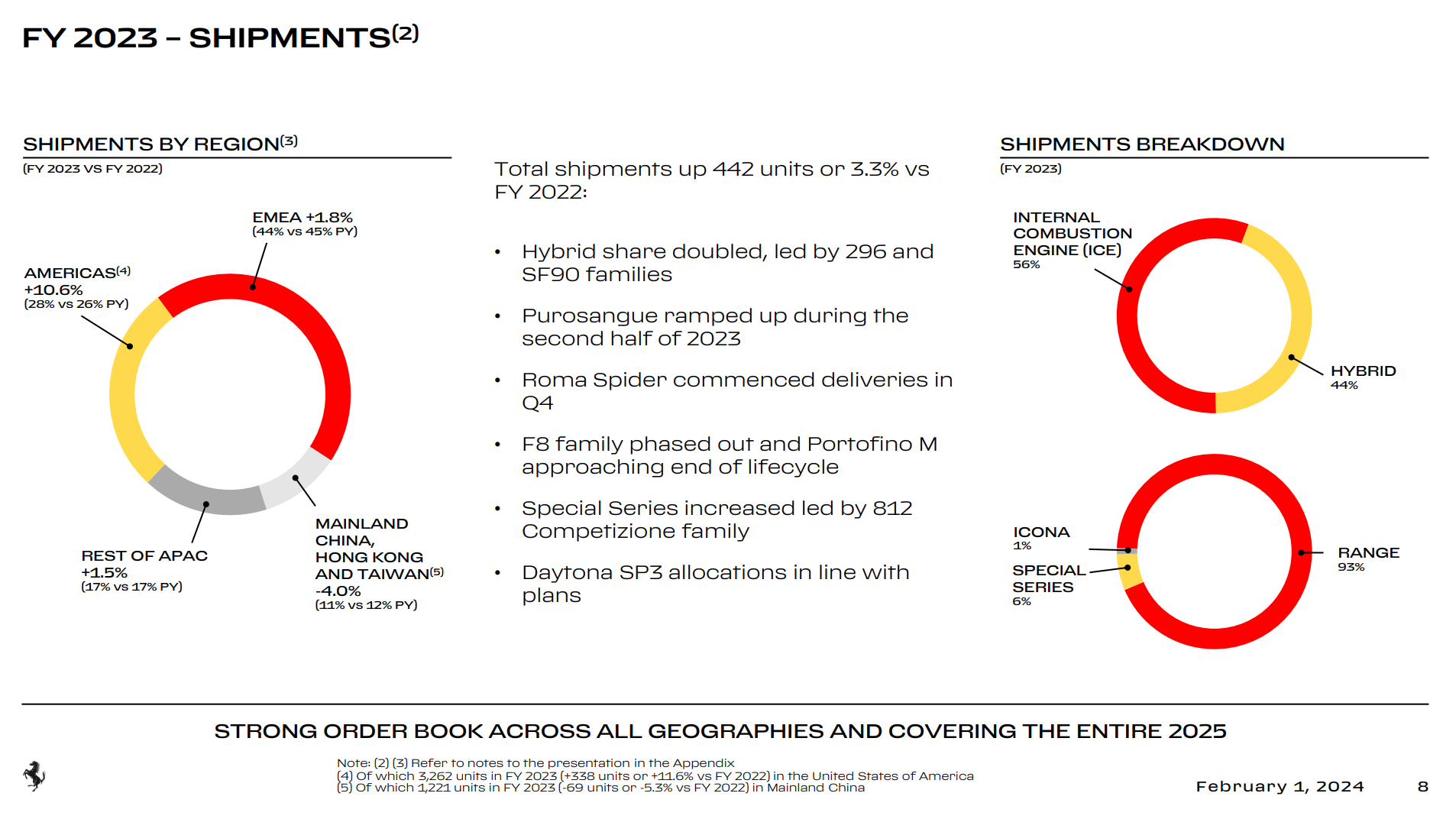

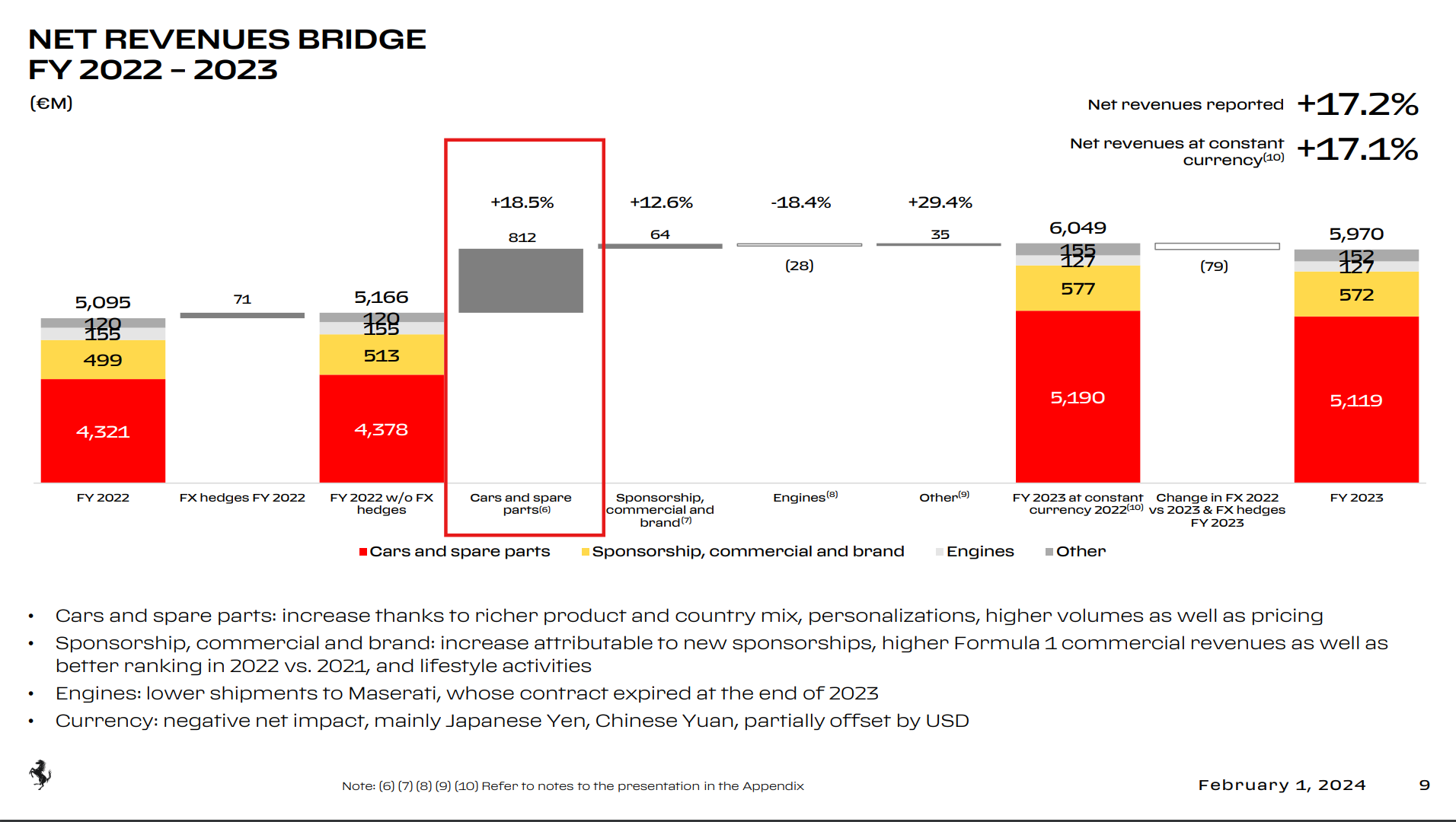

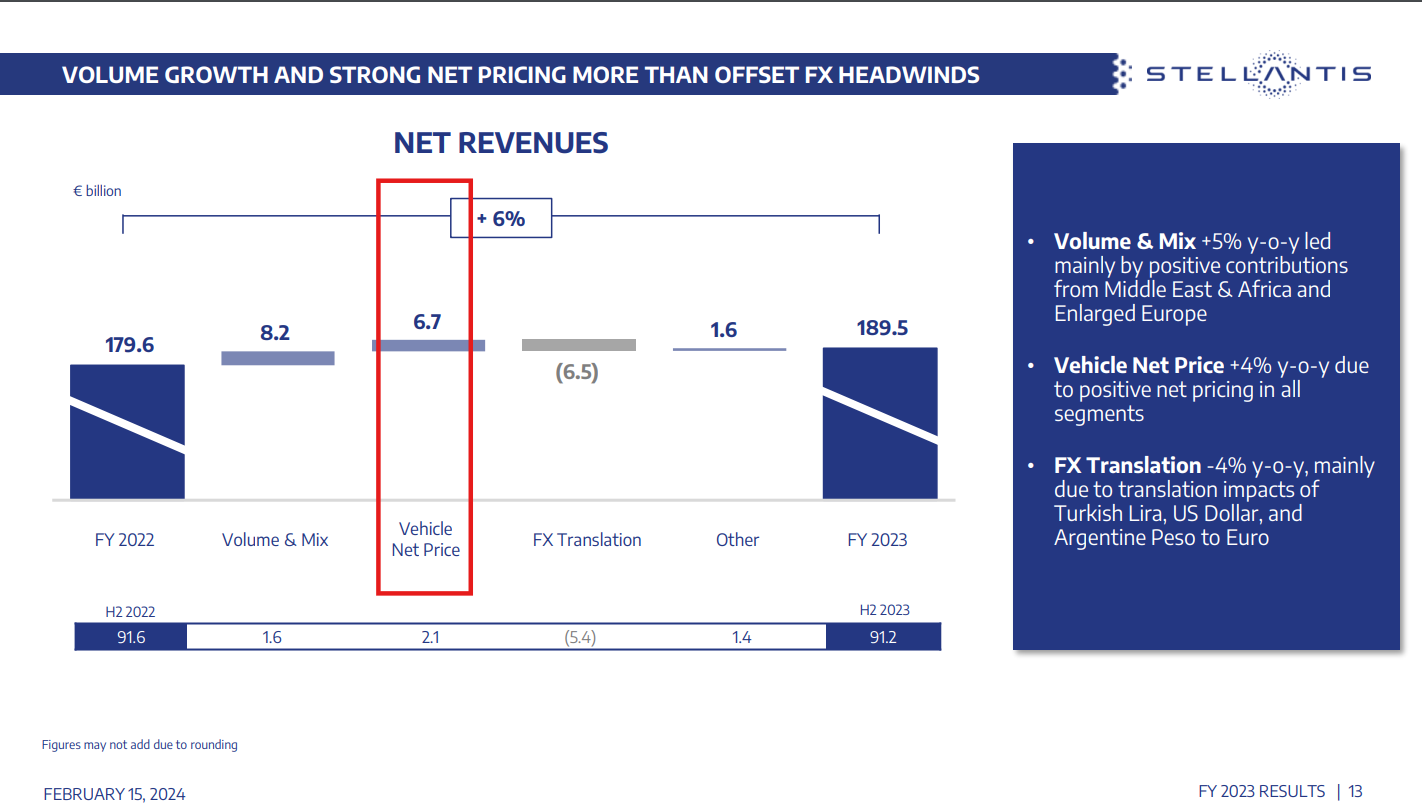

For context, Ferrari, who manufactures and sells high-end luxury automobiles under its namesake brand, shipped 13,663 units in 2023. Stellantis ($STLA), its former parent company and more "traditional" automobile OEM who sells under brands such as Chrysler, Jeep, Dodge, Ram, Peugeot, Alfa Romeo, Maserati and Fiat, shipped 6.2 million. The above market valuations implies $5.75 million for each car shipped by Ferrari in 2023 versus less than $10,000 for Stellantis. And Ferrari's order book is reportedly sold out through 2025. Suffice it to say, the economics of producing and selling a few high-end luxury automobiles to rich folks are far superior to producing and selling huge quantities of more pedestrian brands at less than 1/10th the price on average (Ferrari car and spare parts revenues in 2023 was around $375k per unit shipped whereas Stallantis' was $30.6k).

According to one estimate, there are 225k Ultra High Net Worth Individuals in the U.S. ("Ultra High Net Worth" here means net worth in excess of $30 million). Someone with $30 million who owns exclusively 3-month T-bills generates around $1.5 million of pre-tax income per year at current rates. Assuming an all-in tax rate of 50% leaves $750k of after-tax income. At that rate, that person can afford an average Ferrari 2x over. And that simply was not the case when rates were at 0%, because the income wasn't there. Plus, there are no strings attached, no credit risk, and basically no duration risk in holding short-term T-bills. To borrow a Wall Street phrase, they are "playing with house money" when it comes to interest income.

In this way, the rate hikes have effectively expanded the pool of potential buyers for Ferrari's products. No wonder the company has a record backlog! And that is after reporting +18.5% cars and parts revenue growth in 2023, which was mostly attributable to product mix (i.e. selling higher-priced models) and price increases because shipments were only up 3.3% compared with 2022:

This compares to a more modest but still meaningful net price hike of 6.7% for Stellantis in 2023:

These financial results results have led to $RACE pulling way ahead of peers such as $STLA:

And a higher current earnings multiple than it had at the end of each of the last three years, suggesting the market is forecasting an even rosier outlook for the company:

It's worth considering the impact this has on the economy in real terms. Ferrari has vast real and financial resources available. Its $75 billion market capitalization is supported by the real plants and equipment that are used to design and build the cars, the world-class engineering and manufacturing talent employed by the company, its current inventory, its intellectual property, its sales and marketing divisions, and sales backlog, among other assets. In a world with finite real resources, Ferrari's growth and resource accumulation deprives other parts of the economy of those resources. This is part of the "supply-side" inflation argument, as the company's real resources (which the market estimates is worth $75 billion) is tied up producing and selling high-end luxury vehicles to rich folks and competing in Formula 1 races, rather than deploying those resources in an OEM such as Stellantis which sells more affordable vehicles, let alone towards building public transportation infrastructure that lowers costs for the public at large. We're not policy experts and aren't looking to take positions on matters such as these, but it's useful to understand the consequences of these policy choices especially as it relates to investment decisions.

Looking now to Roche's arguments regarding "$5T of bond losses" and the apparent tightening effect, there are several flaws. Ironically, he contradicts himself: if interest income on Treasuries held at the Fed and in intra-government accounts are irrelevant, why would mark-to-market losses on those securities be relevant? Not to mention, this argument, which emphasizes duration-based market losses, is less applicable when considering reserves and RRP have a duration of basically 0, or when the Fed eats the duration risk of Treasuries and Agency MBS by agreeing to lend against them at 100c on the dollar even if it's trading far below that. It also feels silly to make arguments about losses in financial markets as being a form of "tightening" following the S&P 500's 35th new record close this year alone. And characterizing "unaffordable credit" as supportive of lower prices is a mystery to us; generally, we consider things that are "unaffordable" as being priced too high.

But what these comments reveal is a deeper misunderstanding of finance, banking and markets that is unfortunately widespread and worth spending time explaining.

First, one person's (or entity's) financial asset is another's liability. They are two sides of the same coin. This is a point that MMT beats people over the head with but for some reason doesn't seem to stick and/or resonate. Consider the following comments from Ryan in our podcast Episode #9 in the wake of the 2023 regional banking crisis:

We took out a loan, a mortgage to buy our house back in 2021. We got extremely favorable terms, we got a 2.5% rate on it. That loan, again, is probably trading at like 70 cents on the dollar in the market. Taking it to its logical conclusion, if the banks need to report losses and therefore expenses, like run those expenses through the income account and charge it against their capital balance, then by that same logic, borrowers, such as my wife and I, we should have to report that as income. If our mortgage loan liability was 100 and now it's only 70, that's a reduction in liability. That would be counted as income. So the logical conclusion is that I should report that income to the IRS and have to pay taxes on that income. That's just insane.

To reiterate, a mark-to-market loss on a financial asset (in this case a mortgage) by definition is a mark-to-market gain for whoever issued that paper. People were arguing at the time that SVB and First Republic should've recorded losses in their Held-To-Maturity portfolios (reducing their taxable income in the process). By that logic, the borrowers/issuers of those loans should record gains - and pay taxes on those gains!

A reduction in liabilities has the same impact on net worth as does an increase in assets; this is why when a company buys back its debt at a discount to par value (i.e. below 100), it records a GAAP benefit to net income. That benefit is a cost to whomever paid par for the bonds and subsequently sold them for a loss.

In this way, financial markets are inherently zero-sum. If you paid 100 for a a 2-year T-bill in the fall of 2021 at a 25bp yield, a year later that bond was probably trading around 96. If you sold that security at 96, the 4pt loss you incurred would be recorded as a 4pt gain for the buyer, assuming they held it until maturity and subsequently sold it back to Uncle Sam at 100. This represents an income shift between parties, not an aggregate loss per se. In aggregate, the gains and losses cancel each other out. If the person who paid 100 for that 2-year T-bill held it until maturity, there would be no gain or loss. The amount of income they would have generated would have been the same (two years of 25bp compounded or about 50bp) regardless of whether the Fed kept rates flat over that period or jacked them up to 5%. That is why rate hikes are inherently additive to the non-government sector's "money supply" or net financial assets: when the Fed raises rates, the U.S. government increases its spending without an offsetting tax hike, thus increasing the pool of private sector financial savings.

Likewise, in banking any "losses" in a HTM book must be considered against the banks liabilities, including its deposits. Mosler explained this in our podcast Episode #12:

But what it is, it's like on the other side, let's say they have compensating balances for their checking accounts that don't earn interest, let's say. And you can't move those. So I've got an account, and I have to keep 250,000 in my checking account, my business account. And I can't move it. I've signed on for five years or something with the bank. And so they consider the cost of that money and the duration as five years. They make you a mortgage with a five-year fixed rate of 3% and they're giving me zero for five years, whatever I'm locked in. So now they've got a match. So now the regulators come in and say, hey, you've got a 3% mortgage, your rates go up, you got to pay 6% for money, you're going to lose. They go, oh, wait a minute, over here, I've got this deposit, it's on my business accounts that are locked up for five years at 0% as that company's cost of being able to do business with me. I'm allocating those against this loan book. It's a payoff, you know, so I'll put this in hold to maturity and I'm just going to accrue the 3% over five years.

Twitter/X user @Aureliusltd28 (who is a fantastic follow for anyone interested in bank stocks) recently summed this point up nicely with the following tweet:

Let’s play a game and assume there are $17T in bank deposits.

— Aurelius (@Aureliusltd28) May 30, 2024

And let’s pretend total Cost of Deposits is 3% (it’s lower) and the average life of bank deposits is 3 years (it’s longer).

With FF @ 5.5% then the unrealized GAINS on bank deposits are roughly …. $1.313 trillion… https://t.co/Wz2WRmHuwP

Let’s play a game and assume there are $17T in bank deposits.

And let’s pretend total Cost of Deposits is 3% (it’s lower) and the average life of bank deposits is 3 years (it’s longer).

With FF @ 5.5% then the unrealized GAINS on bank deposits are roughly …. $1.313 trillion with a T

Once again, we see the zero-sum nature of financial markets. Any sound macroeconomic analysis must be done in a stock-flow-consistent manner, with all balances ultimately netting out to $0.

So the bottom line is the so-called "tightening" of financial conditions as argued by Roche and many others is erroneous. The losses incurred by some are exactly offset by gains for someone else. Because the U.S. government is a net payer of interest to the private sector, rate hikes in aggregate increase private sector incomes and add to net financial savings. Characterizing this as "tightening" is completely backwards, in our view. That's not to say there aren't consequences of these actions; as we saw with $AXP and $RACE, wealthy folks and companies that sell goods and services to them are direct and indirect beneficiaries of the Fed's rate hikes. This can cause imbalances in the economy that traps real resources, depriving other areas of the economy of that could use those resources to greater public benefit. These "shortages" contribute to inflation, while the additional income paid by the government to the private sector supports higher prices that sellers charge. We're not advocating for any specific policy, but it's useful to understand when analyzing companies and industries the source of their newfound financial windfall.