People often decry our floating exchange, non-convertible, "fiat" currency regime for being subject to abuse by "politicians looking to buy votes" and "spending money like a drunken sailor," encumbering our children and grandchildren with crippling debt in the process that they'll never be able to pay back.

In reality, current levels of government spending is too low, at least relative to taxation and other demand-inhibiting policies, and the 6.5 million Americans currently unemployed is proof.

Anchors Away

Earlier this year on March 27, 2024 psychologist Daniel Kahneman passed away at 90 years old. Kahneman and his partner Amos Tversky were influential in a field that has become known as "Behavioral Finance." His magnum opus book, Thinking, Fast and Slow, was mandatory reading when I took finance related courses as an undergraduate student. In Thinking, Fast and Slow, Kahneman shows how humans are prone to biases that lead to faulty logic and decision making. An example of this is the concept of "anchoring." Wikipedia defines anchoring as "a psychological phenomenon in which an individual's judgements or decisions are influenced by a reference point or "anchor" which can be completely irrelevant."

There is perhaps no better example of "anchoring" than mainstream economists' views on so-called "full" employment. Many economists consider 5% unemployment to indicate an economy at full employment. And yet, we have maintained an unemployment rate below 4% for 26 straight months! This is one of the reasons this recent period has been so shocking to mainstream economists; according to their models, we're at "full employment," and yet month after month, the US economy has been adding hundreds of thousands of jobs. But if we try to claim we're anywhere other than "full employment," we are dismissed as heretics.

So ignore the economists' claims of full employment and free yourself of the anchoring bias that disrupts rational thinking as it relates to unemployment. An economy that runs an unemployment rate anywhere above 0.0% is by definition not at full employment. Let's consider what that means.

USD Shortage

According to the BLS, as of April of this year, there are 6.5 million Americans who are currently unemployed (a 3.9% rate). The BLS defines "unemployed" as follows: "People are classified as unemployed if they do not have a job, have actively looked for work in the prior 4 weeks, and are currently available for work." In other words, there are 6.5 million Americans currently seeking work and unable to find it. These people are offering their labor at a price in US dollars (i.e. they are sellers of labor, buyers of USD) and there is no bid (or at least, not a bid that is sufficiently high to justify coming off unemployment assistance). Said differently, there is an insufficient supply of US dollars in the private sector to employ millions of Americans. Fewer people working means less real wealth, so keeping the money supply artificially tight is a recipe for making us collectively poorer.

Despite this reality, many people still advocate for a return to a gold standard, or investing in cryptocurrencies such as Bitcoin, who's fixed supply supposedly gives it "scarcity value".

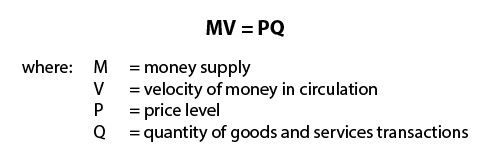

Indeed, obsessions over the "money supply" have long dominated economic theory and discourse, based on the unfortunate myth that money is somehow a scarce natural resource rather than a clever human invention. The equation of exchange, perhaps one of the most basic, foundational concepts in mainstream economics, reads as follows:

This was first expressed algebraically by Irving Fisher in 1911, and laid the foundation for the Monetarist economic movement in the United States, led by the much-celebrated Milton Friedman. Friedman, a self-described libertarian who extolled the virtues of free markets and private enterprise while spending his entire professional life in academia and public service, pushed the idea that the Fed could control the money supply, expanding it during economic weakness and contracting it if things got too hot. In doing so, it was argued, a government's central bank could maximize real economic output while protecting against inflation. Of course, all of this was arrant nonsense, as the Fed couldn't even define, let alone control, the so-called "money supply." Friedman acknowledged he was wrong later in life.

Returning to the topic at hand, while people (particularly goldbugs and Bitcoin hyperinflationistas) obsess over concepts relating to "money supply," little attention is ever paid to money demand. There is an implicit assumption in mainstream economics that demand for money is infinite, but what good is having money if you can't buy anything with it?

Bitcoin and gold are celebrated for their supposed scarce supply. But supply is meaningless without a demand component. Their enthusiasts ignore the ostensible scarce supply of US dollars relative to demand, and the 6.5 million unemployed Americans is evidence that supply is currently too low.

The dollar shortage means markets are unable to clear. It's why a Federal Job Guarantee program (aka "Employer of Last Resort" or "Transition Job") is such a compelling policy idea: the government would establish a floor for the price of the non-government's labor, allowing the market to clear and USD supply to come in balance with demand. Doing so would also increase the pool of available workers the private sector can hire, while tethering the USD to the price of one's labor rather than debasing the currency by handing out freebies. In our view, this would ease inflation pressures.

We're not policy experts per se, and are open to other prescriptions to cure the USD shortage. But we see a lot of content online from folks warning about a coming collapse in the US dollar, usually associated with some sort of meme/trope about governments printing money and Weimar Germany. And this often comes from people "talking their own book" (e.g. they are long gold and/or Bitcoin and stand to benefit from their prices rising). Ignore these predators. There are 6.5 million Americans bidding for US dollars that aren't getting hit. The US dollar isn't collapsing anytime soon.