How Fed Rate Hikes Fueled a Surge in Travel and Leisure Spending

Examining the under-appreciated positive impact interest rate hikes have had on on the travel and leisure industry.

One of the discussions we've been having at AppliedMMT is the under-appreciated positive impact interest rate hikes have had on on the travel and leisure industry. The logic is as follows: Baby Boomers hold a disproportionate amount of financial savings in the US, and are therefore direct beneficiaries of the Fed's interest rate hikes, as they receive that interest income either directly through holding Treasuries or indirectly through interest paid on bank account balances or other financial savings instruments. As they age into retirement, they tend to spend a higher portion of their discretionary income on travel and leisure; indeed, Baby Boomers are the highest spenders in that category. Our thesis was that this combination of factors would lead to a boom in the travel and leisure industry, helping support economic growth. Indeed, that is exactly what has happened. In Episode 18 of our podcast, Douglas and Ryan had the following exchange:

Douglas: You know, at the end of December, I put out my 2023, you know, here's what I think is gonna happen thread right, as argument was really simple. You're about to print a billion or trillion plus of interest income, additional from the year prior, we're coming off a major reset both fiscal and the banking cycle, that massive transfer from the government sector to the private sector, in terms of interest income, is going to not only support the banking cycle, but it's also going to support albeit regressively the private sector as well, the consumer, ultimately, and you just don't see recessions when government spending is firing higher. And I think what's most telling is what, you know, when I'll get my little battles on the interwebs, and I point out, you know, hey, look, you know, only MMT was, was calling this well, everyone knew this was gonna hit, you know, everyone knew that the government was going to stimulate all this money.

Well, no one did. I mean, no one, no one did. And it's such a validation that not only did we say that we'd be better off now than what was expected. We also explained exactly how it was going to happen, and everyone can now look back and they're starting to connect the dots, holy crap, there's this extra trillion dollars plus that wasn't there last year, that is there this year. This had to be, you know, this had to be the reason. And and so at least they're connecting the first dot, but there's still two or three dots away from connecting the whole picture in terms of why rates, higher rates are not actually constricted, right? In other words, no, you're not going to get a big collapse with higher rates, as long as, as long as the public debt to GDP is relatively high. And we you know, we're there because you're just gonna you're giving the bank's free income not only on their on their treasuries, we'll talk about that in a second, but also, on the reserves.

Now to in the in the post great financial crisis era, their balance sheets are great right now. And all we're seeing across the board is, is the capacity for the consumer to consume. I was, I saw, I'm a big Disney fan, as some of you guys know, I love love the Disney parks and want the company to do well. And I was seeing an overview of their financials. And the Disney the department, the overarching department, which includes the parks and the cruise ships, that that stuff was up 13%, year over year, revenue. 13%.

Okay, Disney parks, and cruises only go if people have lots of money to spend, right, like people go and see movies, when they're broke. They go on $5,000 vacations when they are feeling flush with cash. People are going on $5,000 vacations. I'm not saying from a more political aspect that the high rates aren't regressive. But in terms of understanding markets and understanding where we're at, clearly, this additional interest income is finding its way to the consumer trickling down for whatever mechanism was in place to allow it to happen. It's happening. And we're seeing it and I know, Ryan, you've you've ran across this with the banks and that sort of thing.

It just continues to play out the way that we would have anticipated. And the fact that yeah, not only were we able to understand the additional interest income would be there, but that we're not going to have some banking crisis with higher interest rates, because that pads the balance sheets of the banks and makes the consumer gives the consumer higher income to adjust for that now higher cost of money.

Ryan: Right. Yeah, I mean, the, you know, the Boomer grandmas, wanting to take their kids to Disney World, and they're getting basically free income from the government to do so right now. I mean, that shouldn't be really complicated.

Cruise lines present an interesting case. Other subcategories, including airlines and hotels, may be experiencing headwinds from a decline in business travel thanks to the rise of Zoom and other video conferencing technologies. Cruises by contrast are a "pure play" proxy for travel and leisure spending. In addition, there is no quick or easy way for cruise line operators to add capacity: the ships take years to build. Like the shipping industry in general, cruise line operators exhibit enormous amounts of operating leverage, as once the company generates sufficient revenue to cover its fixed costs, roughly 75¢ of each additional dollar in revenue flows to the bottom line.

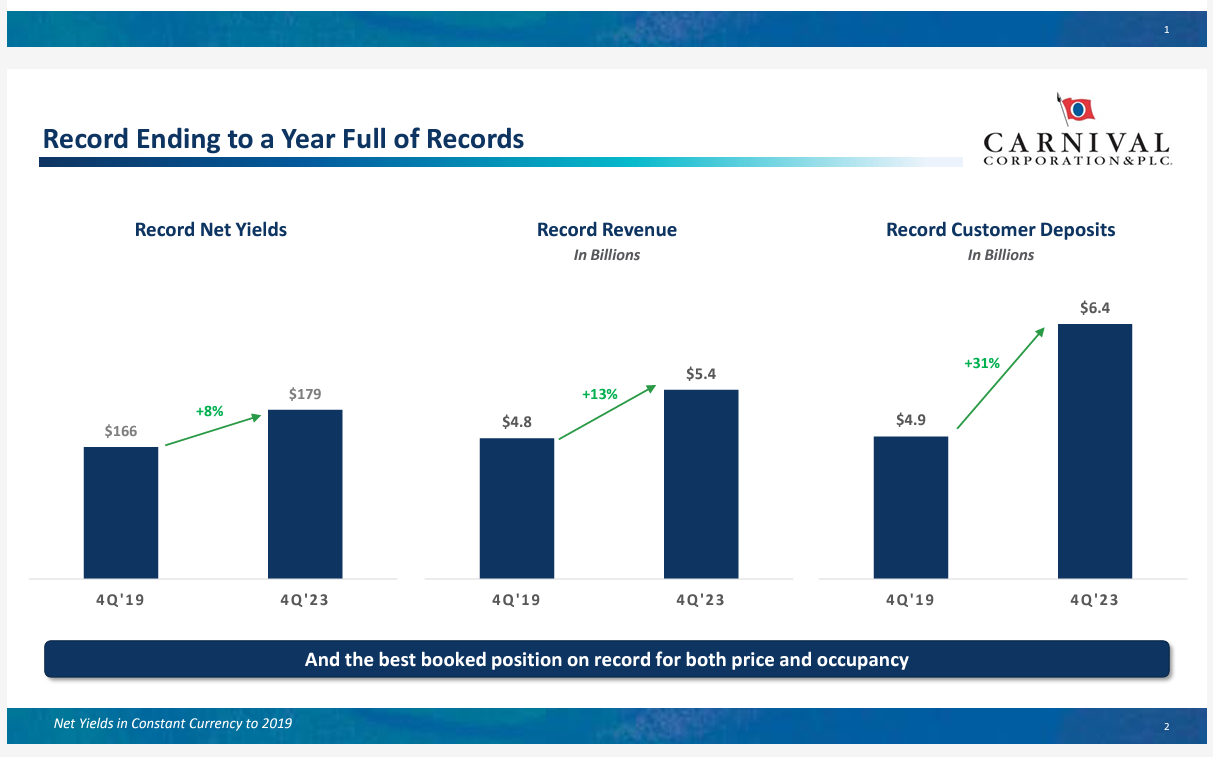

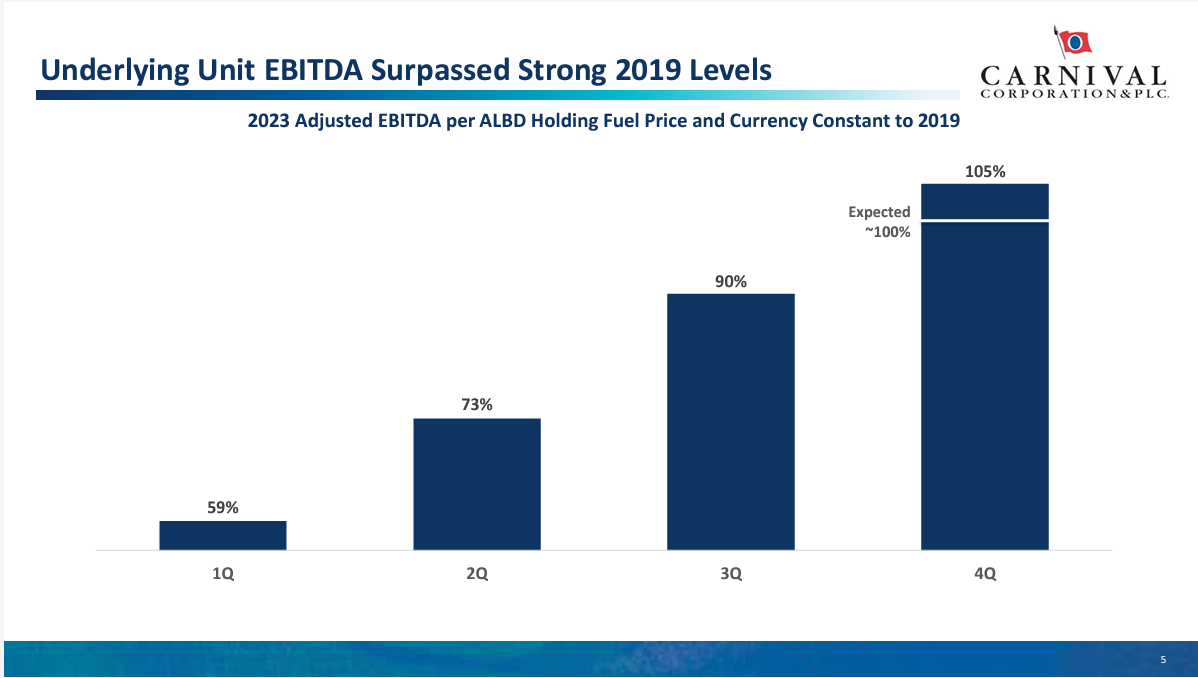

By following the AppliedMMT approach to predicting economic and financial outcomes, one would expect a bonanza in cruise liner earnings. The combination of fixed industry supply and growing demand thanks to interest paid by the US government to Baby Boomers who are retiring and want to travel would logically result in new pricing power for the cruise line operators. Indeed, that is exactly what has happened. For the fiscal year ended November 30, 2023, Carnival Corporation ($CCL) carried 12.5 million guests and generated $21.6 billion of revenues and $2.0 billion of operating income. These results were up meaningfully compared to fiscal 2022, when $CCL carried 7.7 million passengers while generating $12.2 billion in revenues and reported an operating loss of $4.4 billion. So while passengers carried grew 62% year-on-year in 2023, total revenues grew 77%. That 15-point difference is therefore attributable to $CCL raising prices, enabling the $6.4 billion positive P&L swing. In its latest earnings presentation, $CCL provided several slides showing the improved unit economics the company is currently enjoying compared to 2019:

At JPMorgan's recent high yield and leveraged finance conference in Miami, Ryan asked a panel of retailer and consumer discretionary experts whether the rate hikes were having a positive impact on demand for cruises thanks to the increase in Boomers' discretionary income. Assuming $100,000 of cash savings and a 4% rate yields $4,000 in additional annual income that was not available during the ZIRP period. One of the panelists who covers the industry answered with a resounding "yes," adding that in an earlier presentation, Carnival's management team spoke of "generational demand." He further explained that Boomers' spending on trips (including cruises) is a form of wealth transfer, as they are often paying for trips not just with their kids, but with their grandkids. So yes, we can confirm that the rate hikes are in fact stimulating demand for the travel and leisure industry, just as we predicted using our framework.

And this insight provided actionable, value-enhancing ideas for investors, as the three largest publicly traded cruise line stocks Carnival ($CCL), Royal Caribbean ($RCL), and Norwegian ($NCLH) have all outpaced the S&P 500 over the last year:

Our framework is not only useful for modelling and predicting aggregates, but also for anticipating the distributional impacts of policy decisions, which can enable unique insights and investment ideas. This is a topic we will explore further in the coming months.