This past Tuesday, Bloomberg released an article highlighting recent spikes in the overnight funding markets. Alex Harris writes:

"Spikes in a key short-term interest rate are raising eyebrows in the arcane-but vital overnight funding market, drawing unsettling comparisons with turmoil that rocked the space more than four years ago. Strains started showing up late last week. The bond-buying frenzy that stoked November’s US debt rally led to a surge in demand for financing in the market for repurchase agreements, where participants engage in short-term lending or borrowing that’s collateralized by government securities.

This led to a large jump in short-term rates on the final trading day of November, with yields on overnight general collateral repo soaring above 5.5%. Even more unusual, the elevated levels persisted as December began.

The episode conjured memories of the market ructions that occurred in September 2019, even if the latest moves were of a much lesser magnitude. Back then, increased government borrowing exacerbated a shortage of bank reserves that was created when the Fed stopped buying as many Treasuries for its balance sheet and investors had to take up the slack. Overnight repo rates in funding markets — widely relied upon by Wall Street banks to fund day-to-day operations — rose to as high as 10%, and the Fed ultimately intervened by re-starting purchases of the securities to stabilize the market."

Let's unpack this. In a repurchase agreement or "repo" transaction, one party ("Party A") sells a US Treasury or Agency security to another ("Party B") for cash, with a promise to repurchase it shortly after at a higher price. The difference in price is classified as interest. Because of the short-term nature of the transaction (usually ranging from overnight to a week), legally the security never changes ownership. Essentially, Party A issues a Repo liability to purchase funds (cash), and Party B converts its cash to a Reverse Repo asset, and the transaction is secured by Party A's securities as collateral. It is a critical market that enables financial institutions to leverage their balance sheets to access short-term credit.

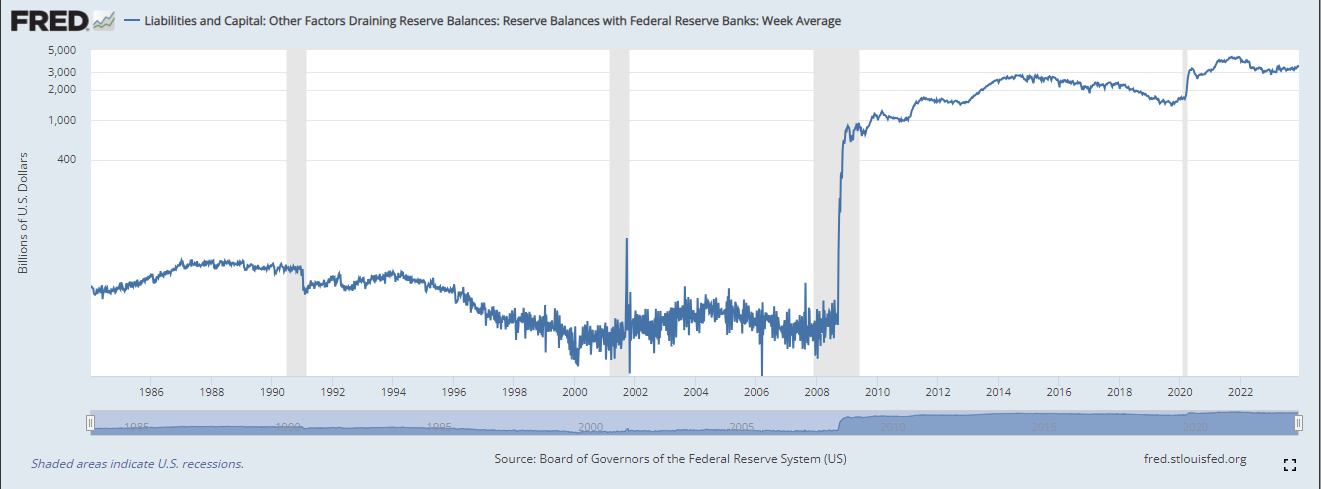

An overview of the Fed's involvement in repo and reverse repo markets can be found here. The Fed has been using repo market operations since the 1920s. In 2008, Congress passed a law that enabled the Fed to set short-term interest rates directly by paying interest on reserve balances (IORB). As a reminder, reserves function as "cash" for banks: they are Fed liabilities and commercial bank assets, just like deposits are commercial bank liabilities and simultaneously assets for households, businesses, and municipalities (i.e. your savings and/or checking account at a bank is that bank's deposit liability). The legal change that enabled the Fed to pay IORB was originally set in motion in the early 2000s: economists had projected the US would pay off all of its debt by 2012, which prompted fears that the Fed would no longer have a mechanism to control short-term interest rates.

There was a secret memo called "Life After Debt" released by the Clinton administration that NPR obtained via FOIA request that outlined these fears. By granting the Fed with the power to set the Federal Funds Rate directly, the same coordination between the Fed, Treasury, and commercial banks to conduct monetary policy as outlined in brilliant detail by Stephanie Kelton (then Stephanie Bell) over a quarter century ago was no longer needed; the Fed could run an "ample reserves regime" while maintaining control of the funds rate. Notice the jump in reserve balances in 2008:

One problem that arose with this new paradigm was certain entities with Fed accounts were precluded from Fed IORB payments. As the Fed conducted its various QE programs in the wake of the Global Financial Crisis, reserves grew in those accounts, putting downward pressure on the federal funds rate. To ameliorate this, the Fed established the overnight reverse repo facility ("ON RRP"). Primary dealers, GSEs, and MMFs all participate in the Fed's ON RRP program. The ON RRP offers participants an interest-bearing alternative to reserve accounts, at a rate the Fed controls. In an ON RRP transaction, the Fed sells Treasury or Agency securities to its counterparty, with a promise to buy it back the next day at a slightly higher price, temporarily draining reserves in the process.

As an aside, there is a whole cottage industry of financial plumbing "experts" who view the use of ON RRP as an indicator of a shortage of collateral, which in their view restricts banks' ability to lend, signaling impending doom. This is incorrect; banks do not need Treasuries or agency securities as collateral before they make loans. By buying up such huge quantities of US Treasury and Agency securities via QE, the Fed effectively replaced Treasuries and Agency securities with reserves and ON RRP. That the Fed for a while chose to pay close to 0% on both reserves and ON RRP, while collecting interest on the securities on the asset side of its balance sheet, meant the Fed reaped enormous profits, which by law were transferred back to the US Treasury. Thus, this "easing" was in fact a form of fiscal tightening, as it drastically reduced the net interest paid to the private (i.e. non-government) sector.

Another new policy tool introduced by the Fed was the Standing Repo Facility ("SRF"). Introduced in July 2021, the SRF provides a backstop for the repo market. In practice, the Fed sets the SRF rate above the going market rate for repo, with auctions that happen later in the day. This allows borrowers to secure funds at the going market rate, knowing they can always fall back on the Fed if need be (technically, the Fed sets a limit to the size of the program, but has discretion to change it if necessary). This effectively sets a ceiling on the repo market.

The establishment of the SRF was set into motion following the September 2019 spike in the cost of borrowing in the overnight repo market, which is at the center of the Bloomberg piece:

As explained by the Fed, the spike occurred due to a shortage of reserve balances thanks to unforeseen tax payments and the settlement of newly issued Treasury securities. As the Fed writes [emphasis added]:

"Two widely cited factors exerted upward pressure on overnight funding rates in mid-September. First, quarterly corporate tax payments that were due on September 16 were withdrawn from bank and money market mutual fund (MMF) accounts and went to the Treasury's account at the Federal Reserve (Fed). Second, $54 billion of long-term Treasury debt settled on September 16, which increased the Treasury holdings of primary dealers that purchase these securities at auctions and finance them through the repo market. As tax payments and the settlement of Treasury auctions drained a large amount of cash, reserves in the banking system declined by about $120 billion over two business days. In the repo market, there were more Treasury securities to be financed in the market that day with relatively less cash. The increase in the repo rates on September 16 seemed to stem from a demand-supply mismatch in the market."

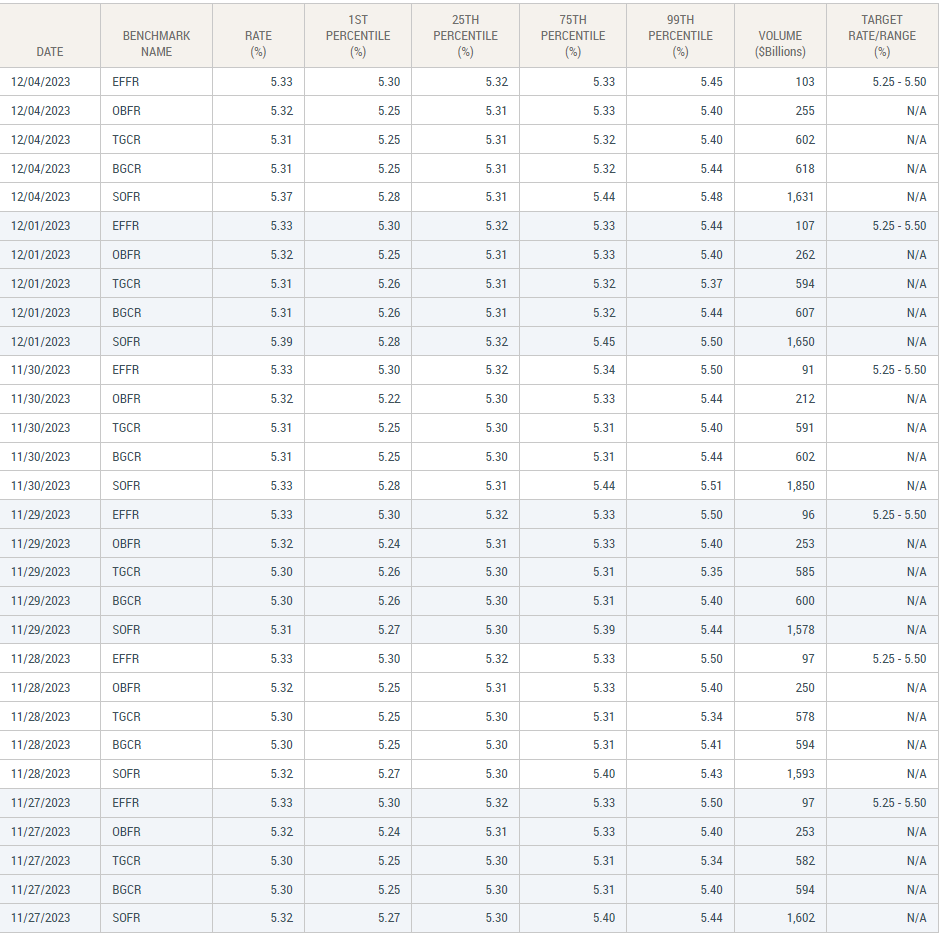

It's important to recognize this was a somewhat one-off timing/settlement issue, as distinct from Bloomberg's narrative that it was due to "increased government borrowing exacerbated a shortage of bank reserves that was created when the Fed stopped buying as many Treasuries for its balance sheet." Further, it is unclear what the Bloomberg author means by "yields on overnight general collateral repo soaring above 5.5%." A look at general collateral overnight rates published by the Fed reveal that the recent high for the November month-end median 99th-volume weighted percentile secured overnight financing rate (SOFR) reached 5.51%:

In other words, one basis point above the current SRF rate:

Comparing this recent episode with September 2019, when overnight rates hit double-digits, seems completely inappropriate to us. If anything, the Fed's new tools, including the SRF, are working as intended. The concerns raised in the Bloomberg article are therefore just noise.