On Thursday, November 9th, financial market participants and the media were borderline hysterical about a supposed "failed" US Treasury auction of 30-year bonds. Here is the Barron's summary [emphasis added]:

The Treasury’s auction of 30-year bonds on Thursday went about as badly as it could, indicating investors are reluctant to own long-dated government securities.

At the auction of government debt that matures in 30 years, investors were awarded 4.769% in yield, 0.051 percentage point higher than the yield in pre-auction trading. The difference between the two yields—called a tail—indicated a weak auction where the U.S. government had to entice investors with a premium over the market to buy their debt.

Primary dealers, who buy up supply not taken by investors, had to accept 24.7% of the debt on offer, more than double the 12% average for the past year.

I know what you're thinking: the answer is no, this is not satire. 0.051 percentage points amounts to 5 basis points. For those unfamiliar, a basis point is equal to 1/100th of 1%. For $100 worth of Treasury bonds, that difference is equivalent to a nickel. And we call that a failure?

The higher-than-average participation of primary dealers supposedly further supports the assertion that this auction was a failure, because it shows a lack of demand from "investors." First, can anyone really blame non-dealer buyers for their reluctance to purchase 30-year US Treasury bonds given the Fed itself seems to have the interest rate policy backwards? More importantly, the fact that this auction "failed" to attract non-dealer buyers, and the dealers stepped in to take down nearly a quarter of the offering, is exactly the point that MMTers have been pounding the table about for decades: the Fed, which is a creature of the US Congress and acts as fiscal agent for the US Treasury, established the primary dealer network to make "competitive" bids at US Treasury auctions. Failing to do so results in a loss of their primary dealer status. Warren Mosler explained this dynamic brilliantly in a recent tweet:

The Treasury is borrowing $ via selling Treasury securities as a matter of public policy. And the Fed, also as a matter of public policy, lends on demand to "captive" primary dealers competing to buy them at auction ultimately on behalf of their clients.

— Warren B. Mosler (@wbmosler) October 31, 2023

Indeed, the dealers are "captive" in that they are required to buy the Treasury's paper. And the Fed accommodates this by debiting their reserves and crediting their securities accounts, hence the point about how the Fed "lends on demand." As a reminder, if the Fed debits dealers' reserves, that is functionally a loan, the same way that institutional money managers (or anyone with a margin account) who run debit balances are borrowing "on margin" from their prime broker.

Further down the same Barron's article, the author writes the following:

If government revenue doesn’t rise, higher spending would lead to a further increase in borrowing. Investors are concerned about who will buy the debt.

Apparently, the journalists at Barron's need to collaborate more with those at their sister company, The Wall Street Journal (who share the same ownership by parent company News Corp). On November 6th, the latter wrote the following [emphasis added]:

Investors are worried that Western governments are issuing more bonds than investors can buy. Whether the system that transacts in those bonds can bear the load could be a much more urgent issue.

Last week, the U.S. Treasury Department said it would issue longer-term debt. Ten-year and 30-year government-bond yields, which had recently touched 16-year highs, have since fallen sharply.

Bond investors across the globe have been particularly jumpy about increases in public-debt supply. The implied threat is that, amid higher inflation and interest rates, they are no longer willing to unflinchingly absorb it. Government debt in rich countries is set to hit 116% of gross domestic product in 2028 from 112% in 2022, the International Monetary Fund forecasts, as officials increase spending on industrial plans and green policies.

Yet the end-buyers of the debt are unlikely to disappear since government deficits automatically create the very savings that are then channeled into financial assets.

The WSJ's acknowledgement of this reality is extremely welcome, and completely at odds with the claims made in the Barron's article. The latter suggests that the Treasury must decrease the budget deficit ("If government revenue doesn't rise...") in order to create more demand for Treasuries. The WSJ points out, correctly, that the deficits themselves provide the sources of funds that buyers use to purchase these securities.

Understanding this very basic operational reality is the crux of the MMT framework, and it's encouraging to see a well-respected publication such as the WSJ recognize it. And that is why the characterization of last week's Treasury auction as a "failure" is egregiously misleading, untruthful, and counterproductive.

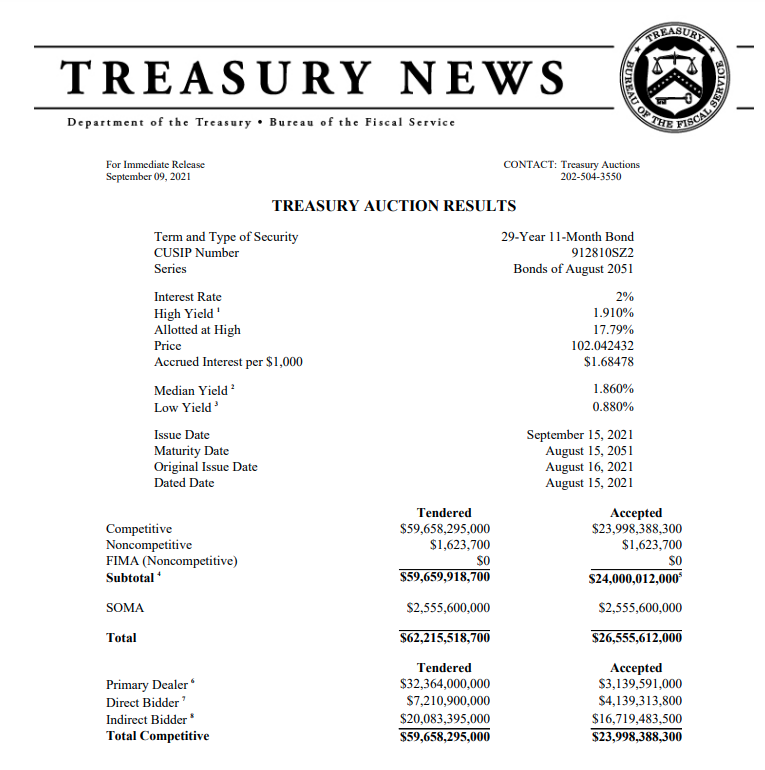

In closing, I'd like to leave readers with a contrarian narrative: Warren Buffett famously advises people to be "greedy when others are fearful, and fearful when others are greedy." A little over two years ago, non-dealer investors couldn't get enough of the long bond when they were offered at historically low yields. Below is the results of the primary auction for the 2% US Treasury bonds due August 2051. As you can see, they exchanged hands at a high yield of 1.91%, an all-time low, and primary dealers took down 13% of the issue:

Yet at last week's auction, non-dealer investors were more reluctant to purchase the 4.75% US Treasury bonds due November 2053, despite an interest rate that is 138% higher!

While there is certainly risk of the Fed continuing to hike rates because it has mistaken the brake for the gas pedal, investors ought to consider heeding Mr. Buffett's advice and be greedy while everyone else is fearful.