This morning, the Bureau of Labor Statistics released their highly anticipated March Consumer Price Index report. Year over year, CPI was slightly higher than expected at 3.8%, compared to the forecasted 3.7%. Consequently, expectations for rate cuts have diminished significantly, and the markets have experienced a modest sell-off.

In December, just a few months ago, Federal Open Market Committee members anticipated several rate cuts in 2024, believing that the rapid rate increases from March 2022 to August 2023 had effectively addressed the inflation issue.

Concurrently, we published our 2023 Wrap-Up, which included Douglas' key predictions for 2024 that countered the FOMC's prognostications:

If you said, Doug, you're gonna wake up January 2nd, probably the first day markets are open you to make your one bet? How's it gonna play out? You're not allowed to take your chips off the table until until December 31st of 2024? What is it going to look like? And here's how I would go – and again, two things really drive markets and two things drive the economy as a whole: fiscal and the endogenous or the bank credit cycle.

So here's my call: I think we're going to continue to see fiscal growth, but it's going to be at a slightly slower pace than we saw in 2023. In terms of that, the change of growth of fiscal, that means then, that bank credit needs to start expanding and that bank credit is going to expand. The endogenous cycle will grow at a faster rate, which wouldn't be too hard in 2023 because we actually saw a contraction. So with those two things in mind that we're going to see an expansion on both fronts, one is going to be slower than the other relative to where it was in 2023 – that being fiscal. That means by the end of 2024, I think we will see markets higher, and probably pretty strongly higher.

I think we will also see, and here are the fun calls, I think we're gonna see inflation higher, I think we're gonna see things like oil higher. And then I ultimately think we're going to end up seeing the Fed funds rate higher at the end of 2024 than it is currently right now.

Here's how we get there, and here's how I could be completely wrong. Now, I can be completely wrong about the second half, but still be right about the first half. I think that is very possible.

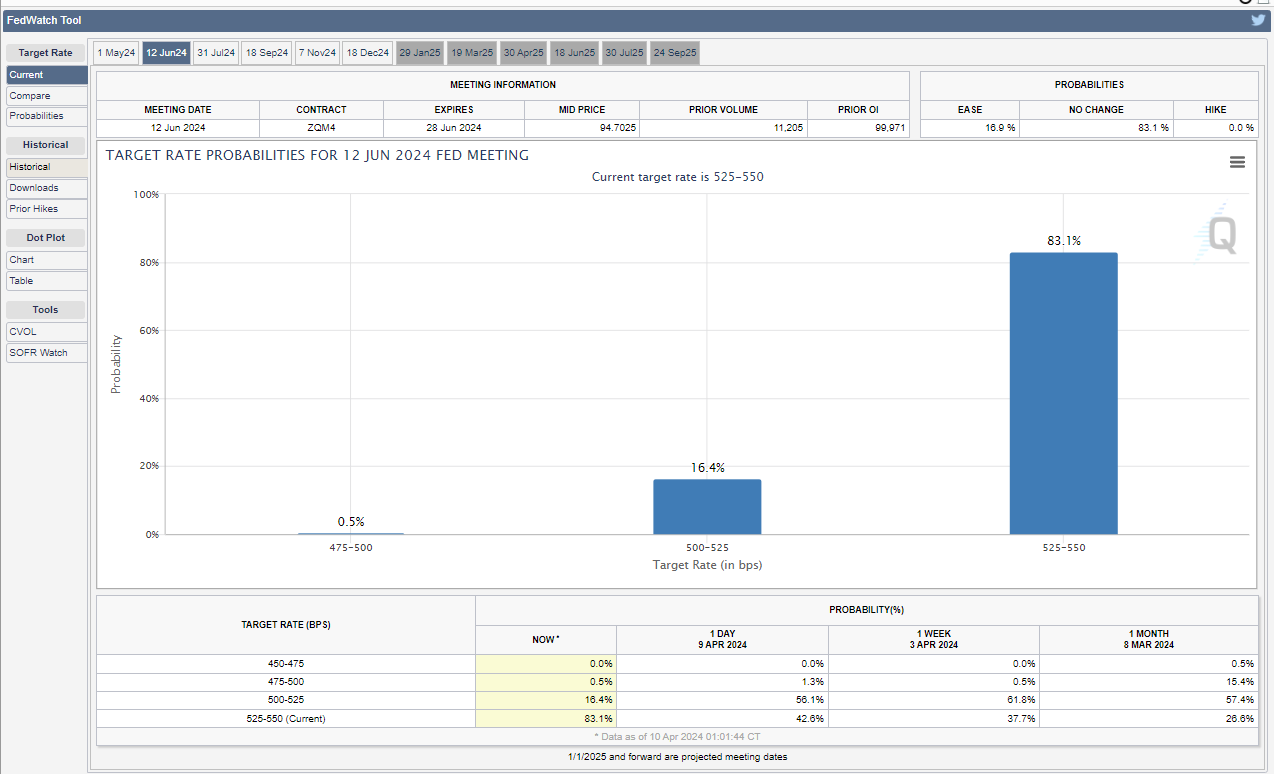

Here's how we're gonna get there, though: we are in a race to March 20th. On March 20th, that is when the Fed has indicated they will likely make their first cut. What we need to see up until March 20 is economic data continue to come in hotter than expected, inflation data to continue to come in hotter than expected, and the employment situation to continue to look stronger than expected. We will have three prints in January, February and then March before the Fed have all of that sort of data the Fed looks at before the Fed will make their decision in in March.

If we see three months of hotter than expected data, of surprising-to-the-upside data, based on the Fed's stated policy – now they could change their policy, they could say up we've got it wrong, 'We were listening to this AppliedMMT Podcast they convinced us that we have it wrong', but based on their stated policy right now, they will raise interest rates, which we know from 2023, raising interest rates only perpetuates the growth cycle, because of everything we've talked about so far.

So my guess is by March, they're not going to be cutting, they might even be indicating that maybe within a month or two of the May, I think there's a May and June meeting in there or something like that, that by summer 2024, they might actually have to increase, right? So in other words, we don't get a decrease ever, we never get a cut. And if that ends up taking place, we will get the echo boom of inflation in 2024, without a doubt.

As we have stated repeatedly over the past 18 months (along with others in the MMT community, including Warren Mosler), we believe the Fed has misconstrued the effects of rate adjustments. Rate increases can be stimulative and inflationary for these key reasons:

- The federal government is a net payer of interest. The Fed's recent rate hiking campaign has taken annualized payments to Treasury holders from ~$517 billion in Q4 2020 to $1.025 trillion in Q4 2023.

- The term structure of prices, as discussed by Mosler in this 2017 lecture at the 53:15 mark.

- Higher risk-free rates incentivize endogenous money creation (bank lending) as lending becomes more profitable for banks and provides them with "insurance" on potential defaults. We discussed this at length during our conversation with Ritik Goyal.

In 2021, Stephanie Kelton posed a question to Harvard economist Jason Furman about the counterintuitive possibility that higher interest rates could lead to higher inflation, only to receive a curt dismissal:

No

— Jason Furman (@jasonfurman) April 8, 2021

Maybe recent developments will encourage the mainstream to reconsider their thinking on monetary policy – though that seems even less likely than the Fed cutting rates in the near future.