When I first learned about Modern Monetary Theory (MMT), I was shocked at how remarkably prescient its adherents seemed to be. ”So you’re telling me,” I would say to myself, “that there is a small cohort of heterodox economists who correctly predicted the 2000 recession, the Global Financial Crisis, and the European Sovereign Debt Crisis? And they also dismissed claims that QE would cause inflation, the US could involuntarily default on its debt, and that Japan was on the verge of a sovereign debt crisis?* Who the heck are these people and why haven’t I heard of them before?”

*Shorting Japanese Government Bonds (JGBs) became an infamous "widowmaker" trade in the Global Macro hedge fund world, where everyone who tried it failed. Investopedia has a whole section dedicated to it here.

I became inspired to dig deeper to better understand the MMT framework for analysis and apply it to financial markets. As it turned out, there was a small (but growing) community of devout MMT adherents who shared the same passion. We all came to similar conclusions in the fourth quarter of 2022: while the overwhelming majority of mainstream economists, financial analysts, and media pundits warned of a coming recession in 2023, we believed the odds of a recession were very low, and risk assets such as equities and low-grade corporate credits would perform well. Our collective success in 2023 serves as a searing vindication for the MMT framework for analysis, and provided the inspiration for the launch of AppliedMMT.

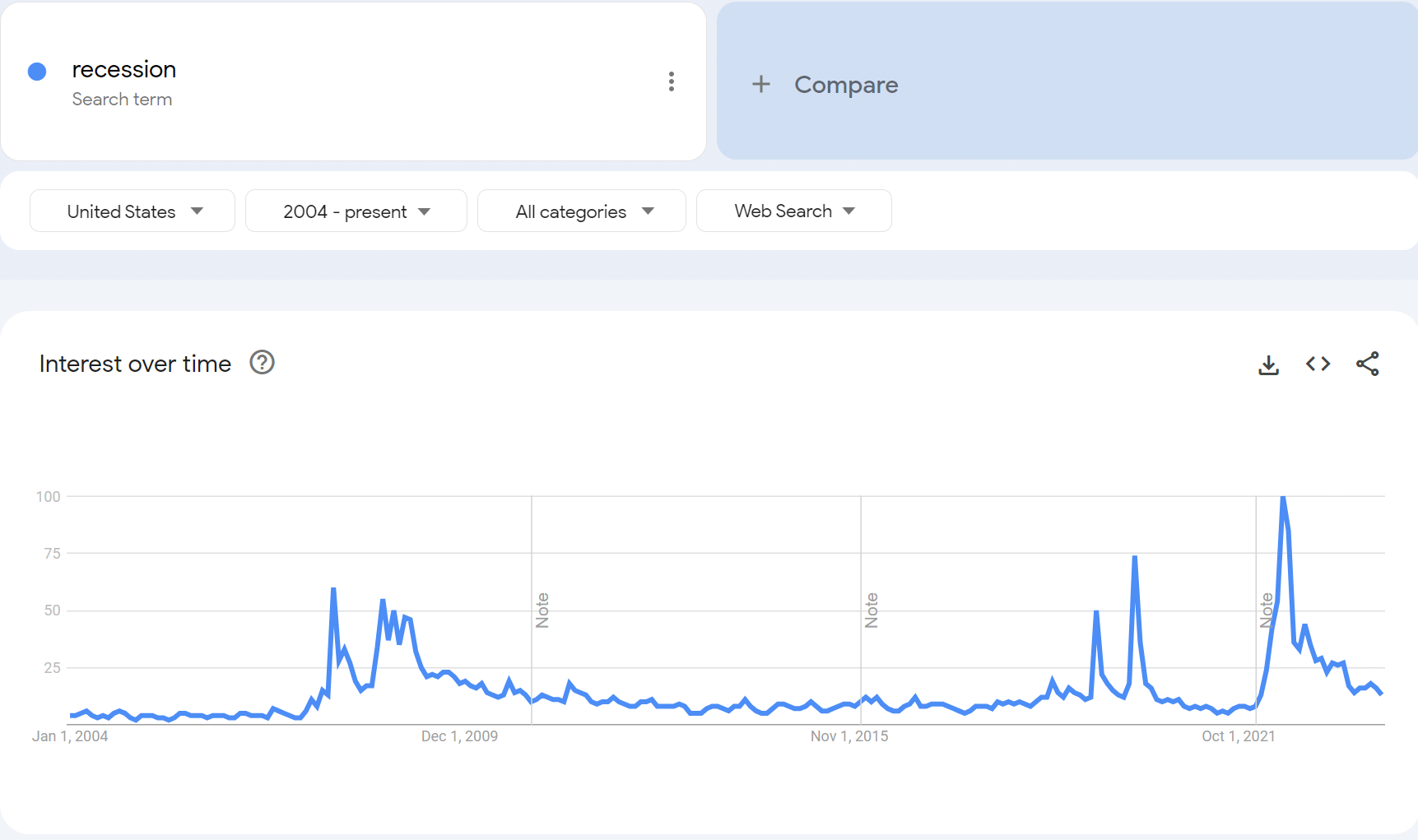

The narrative of an impending recession in 2022 was overwhelmingly accepted as a consensus, making it difficult to contextualize. A quick search on Google Trends show the term "recession" appeared on a record amount of Google searches in August 2022, exceeding levels from the Global Financial Crisis and the 2020 COVID-19 recession:

A headline from a Bloomberg article published on October 17, 2022 was titled "Forecast for US Recession Within Year Hits 100% in Blow to Biden" and opened up with:

A US recession is effectively certain in the next 12 months in new Bloomberg Economics model projections

Just over a year ago to the day, the Wall Street Journal wrote:

Big banks are predicting that an economic downturn is fast approaching.

More than two-thirds of the economists at 23 large financial institutions that do business directly with the Federal Reserve are betting the U.S. will have a recession in 2023. Two others are predicting a recession in 2024.

JPMorgan Chase CEO Jamie Dimon warned of an "economic hurricane" on the horizon in June 2022. Goldman Sachs Chief David Solomon said in an interview with CNBC there was a "good chance of a recession," to which Amazon founder and chairman Jeff Bezos replied, "Yep, the probabilities in this economy tell you to batten down the hatches." Tesla Inc. non-founder founder and CEO Elon Musk predicted a recession that would last until spring 2024. Anecdotally, I recall a discussion with an employee at a non-profit organization I've volunteered with over the years who lamented the difficult fundraising environment due to "the recession," and conversations with my wife (who works for a jewelry wholesaler) telling me her team regularly discussed the coming recession.

Even the Fed expected a "mild" recession in later 2023 following the March banking crisis that led to the failures of Silicon Valley Bank and First Republic Bank.

A few of us saw things differently. In a blog post I wrote on October 14, 2022, I said the following:

With US debt to GDP at around 120%, the impact of rate hikes on US federal spending is amplified. Total interest paid on Treasury debt is up nearly 30% year-on-year.

This increase in federal spending is a form of fiscal stimulus for people with savings. Similar to the checks sent out to Americans in 2020 and 2021, this increase in government spending stimulates aggregate demand (albeit to a wealthier cohort than the COVID stimulus programs). And yet, the vast majority of the population calls this 'tightening.'

While we have been fairly negative in our outlook for the economy, it appears these rate hikes are having the unintended effect of stimulating aggregate demand, keeping us out of recession. In addition, federal programs such as the CHIPS Act, the Inflation Reduction Act, and President Biden's executive order to cancel a portion of student loans are further sources of stimulus that are coming down the pike.

A few days later, on the very same day Bloomberg came out with its 100% recession odds prediction, I wrote the following in a blog post [emphasis original]:

The implications for this are enormous. Purchasers of both equities and fixed income securities today are getting a bargain relative to a year ago. And in the case of equities, the government is promising to increase the nominal amount of dollars it will spend into the economy via the interest income channel, thus expanding the pool of potential dollars the business can accumulate through its operations. This is perhaps the best buying opportunity of my career. I have been increasing equities exposure lately, with a particular focus on pro-cyclical stocks that will be direct and indirect beneficiaries of recent policies enacted by the federal government, including the Inflation Reduction Act and student loan forgiveness.

Since the "best buying opportunity of my career" call, stock market returns have been robust. Including reinvested dividends, returns of various indexes have been as follows:

S&P 500: +35.8%

Dow Jones: +30.6%

NASDAQ: +47.1%

Russell 2000: +22.8%

Similarly, Adam wrote the following [emphasis original]:

Federal interest expenditures in 2022 are on pace to surpass the entire year’s defense budget.

Interest payments flow from the government to holders of federal debt — other government agencies, households, businesses, pension funds, you name it. This is free money from the federal government.

…but this is considered economic “tightening”?

It’s stunning how rarely this is discussed in the financial media.

Fiscal policy (taxing/spending), which Congress is responsible for, has a much greater impact on the macroeconomy than monetary policy, which the Fed oversees. However, the Fed is effectively engaging in major, albeit regressive, fiscal stimulus by increasing interest income throughout the economy via monetary policy.

Is this good policy? Not in my opinion.

Do we have to worry about a recession because of rate hikes? I think it’s quite the opposite.

Douglas, whom Adam and I had yet to meet, was also pounding the table and wrote this epic Twitter thread:

Want the best Bull case for '23 one that only #MMT understands: A massive wave of billions in free $ is set to hit the private sector via interest payments from the Govt. Before we understand why this will be a + for stocks we need to understand what caused the '22 selloff 1/6🧵 pic.twitter.com/ObMs5d3CDK

— Douglas (@MMTmacrotrader) December 16, 2022

What caused the selloff in 22? A collapse in government deficits. MMT gets that govt spending is private sector saving. Once govt spending reversed in late ’21 the priv sect was reliant on an already flimsy credit cycle 2/6 pic.twitter.com/Is4A9pdJi5

— Douglas (@MMTmacrotrader) December 16, 2022

A credit cycle that ultimately couldn’t hold the weight of the disappearing deficit flows. But this trend is reversing in a big way! With the Fed driving rates higher, we’ll likely see net monthly interest payments nearing $100B per month in 2023. 3/6

— Douglas (@MMTmacrotrader) December 16, 2022

Add to that the Massive new defense bill, lowering oil prices, global DXY shortage calming, and the banking sector about to be chocked full of fresh new capital, and you have markets that are ripe for a turnaround in 2023. 5/6

— Douglas (@MMTmacrotrader) December 16, 2022

Our friend Nick Gomez over at ANG Traders expressed similar views, and was recently awarded second place in a Seeking Alpha contest (congrats, Nick!) for predicting the performance of the S&P 500 in 2023, coming within 130bp of the actual return.

And of course, the Godfather of MMT himself, Warren Mosler, tweeted the following in November 2022:

With quid pro quo keeping oil prices in check inflation is dead as previously discussed. And with the deficit this high+cheap fuel, looks to me like a buy the s and p index and go play golf time until Saudi excess capacity is gone and prices spike.

— Warren B. Mosler (@wbmosler) November 18, 2022

Once again, MMT zigged when nearly everyone else zagged. Once again, MMT nailed an important macro call. The results in 2023 prove that applying MMT to financial markets has real utility for practitioners.

A point of clarification: suggesting the US economy will avoid recession and making a call to buy stocks are obviously distinct from each other. That being said, we know per the Kalecki-Levy Profits Equation that an increase in government net spending supports corporate profits, and by extension supports capital spending and employment. Those factors are critical in helping the US avoid a recession, and are also generally positive for equities and other risk assets. Not only that, but the higher fiscal deficits create private sector financial surpluses, a portion of which is generally allocated to stocks and bonds.

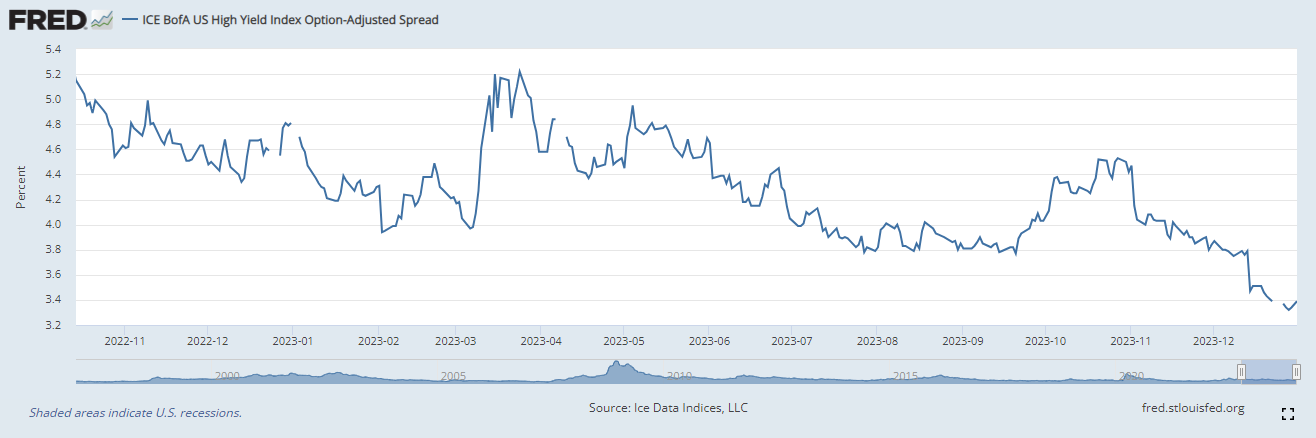

And when profits are high, leverage is low, and people have jobs, that tends to be positive for credit. Indeed, the ICE BofA US High Yield Index Option-Adjusted Spread, which reflects the premium investors demand for non-investment grade corporate bonds versus US Treasuries, has tightened considerably since our call, which is a sign of easing credit conditions:

So how did we all get it right while the most credentialed and well-resourced economists in the world, along with titans of finance and tech industries get it so wrong? Simple: we have a better framework for analyzing the economy and financial markets than they do. They don't understand and/or ignore that money is a simple public monopoly, and fail to consider the consequences thereof. As the saying goes, "garbage in, garbage out."

Goldman's CEO Solomon recently issued a mea culpa:

I don't remember exactly what I said to you up here a year ago but I assume it was some form of predicting a recession in 2023. That turned out to be wrong, in part due to the US government's fiscal spending.

In other words, Solomon confirmed the US avoided a recession for the exact reasons we said it would. We were right for the right reasons.

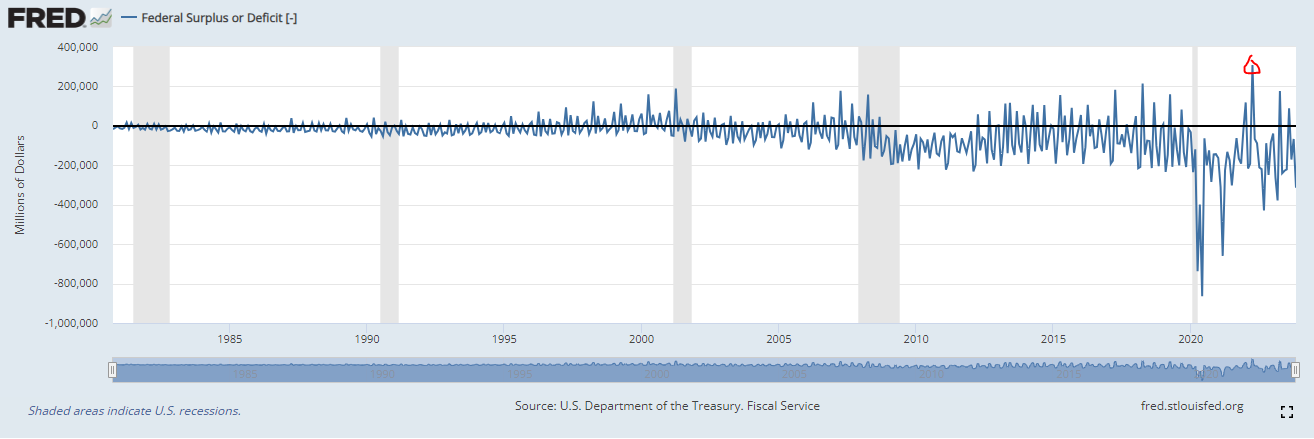

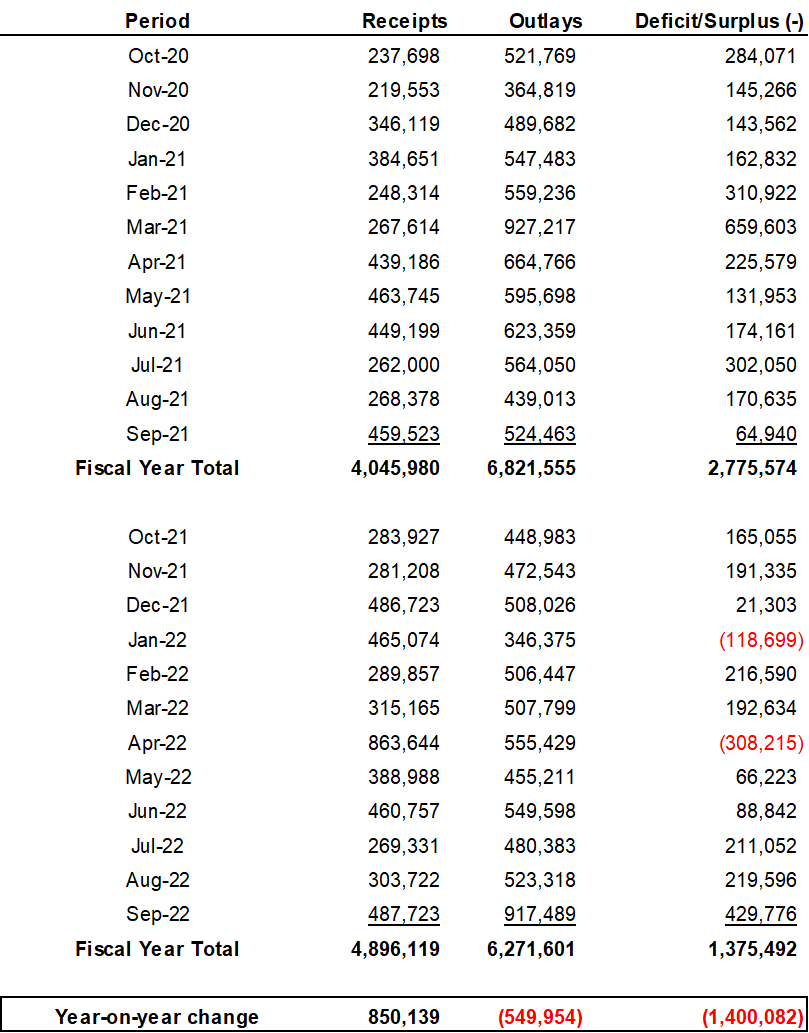

In fairness to the macro bears, there were legitimate concerns about the economic outlook in the middle of 2022. Even Stephanie Kelton, at a presentation at the Levy Institute in June 2022, made a recession call. What was noticeably missing in the mainstream narrative (i.e. outside of MMT circles) was that the economic slowdown we experienced in the first half of 2022 coincided with the largest tax drain in our country's history. That is not an exaggeration: in April 2022 the US federal government ran a $300 billion surplus, its largest monthly surplus ever:

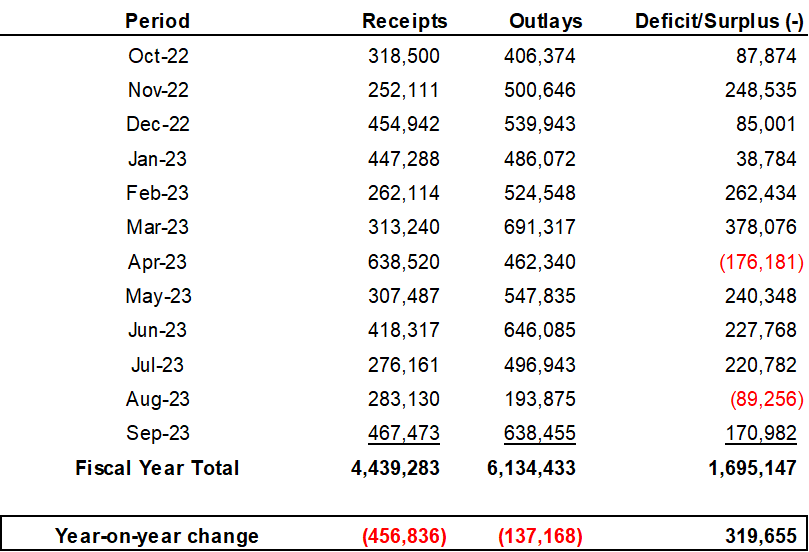

People were blaming the weak economy on rising rates, and completely ignored the $1 trillion fiscal tightening we experienced in fiscal year 2022. Below is a year-over-year comparison of the US federal government monthly deficit/surplus [deficits are positive in black, surpluses are negative in red]:

And with the spike in inflation as a result of the oil shortage following Russia's invasion of Ukraine, in real terms the federal government was actually running a surplus in fiscal 2022, which is exactly what MMT adherents have long argued creates conditions for recessions.

As mentioned, the federal deficit grew year-on-year in 2023:

To her credit, Kelton issued an important qualifier: her recession call assumed no additional spending bills written into law by the US federal government. A couple months later, we got exactly that, as the CHIPS Act and Inflation Reduction Act were passed in August 2022. Additionally, the federal government announced a cost of living adjustment ("COLA") of +8.7% beginning in fiscal year 2023 for social security recipients, further increasing federal outlays. And of course, the Fed hiked rates quickly, and those rate hikes had an almost immediate impact to the economy because the Fed now pays interest on reserve balances. These spending increases offset cuts elsewhere, and contributed to the 23.2% year-on-year deficit increase, helping us avoid a recession.

What made the late 2022/2023 period so incredibly unique was the dislocation between the prevailing economic narrative and reality. Such bifurcations are usually what creates attractive investment opportunities, and 2023 did not disappoint.

As we enter 2024, we continue to believe the current fiscal deficit level is sufficient to avoid recession. And while risk assets aren't the screaming buy they were in fall 2022, the deficit will continue to serve as a tailwind. Additionally, certain pockets of the market (e.g. financials and energy stocks) remain at single-digit multiples of earnings, which could provide attractive buying opportunities. The biggest risk in our view is inflation: energy markets are notoriously difficult to predict and could spike as a result of geopolitics. Additionally, if CPI remains higher than the Fed's 2% target rate, it's likely the Fed will continue to keep rates at elevated levels, which could exacerbate inflation. We will address these issues in future writings.

Thank you for supporting our work. Here's to an even better 2024!